US: Manufacturing flexes its muscle

The strong US growth story isn’t a pure consumer play. The manufacturing sector is going from strength to strength with durable goods orders pointing to robust investment spending through the first half of 2021. 6% full year GDP growth is looking increasingly plausible

Manufacturing orders continue to surge

The January durable goods report shows that the manufacturing sector has well and truly shaken off the disruption from the pandemic. Headline orders rose 3.5% month-on-month, well ahead of the 1.1% consensus and its ninth consecutive monthly rise. Admittedly the highly volatile non-defence aircraft component (Boeing airliners) boosted the figure by jumping 390%, but strip out transportation and orders still rose 1.4% versus the 0.7% consensus forecast. Meanhile, December’s figure was revised up from 1.1% growth to 1.7% growth with robust business surveys, such as the ISM report, suggesting there will be no imminent let-up in the pace of growth.

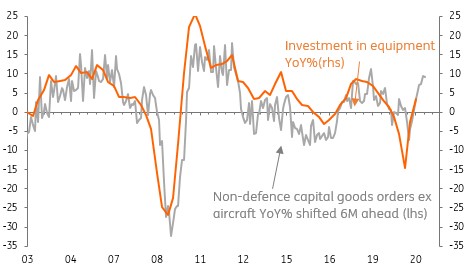

Admittedly the Federal Reserve’s favoured measure – non-defence capital goods orders ex aircraft – rose slightly less than predicted at 0.5% MoM, but December's figure was revised up from 0.7% growth to 1.5% growth. This measure has historically had a great relationship with corporate investment, which is why the Fed watches it, and points to very robust growth.

Durable goods orders & corporate capex

The investment outlook is clearly strengthening

The chart above suggests we should soon see 10% YoY real investment spending growth. Add in remarkably strong residential investment and it is clear that the US growth narrative for 2021 is not purely a household consumption story – note that 4Q20 GDP was revised up to 4.1% from 4% on the back of higher-than-initially thought investment spending.

6% real growth in 2021 is certainly achievable

Putting it all together and another upward revision to our 2021 GDP growth forecast looks inevitable. 6% real growth is certainly achievable.

Ambiguity in jobs numbers

Separately, the headline numbers from the jobless claims report look fantastic – a drop in new weekly claims to 730k from 841k, but we have to be cautious on how we interpret this. The recent winter storms in many parts of the country are going to have influenced the story such as by people not able to register due to office closures and a lack of power. For example the unadjusted figures show jobless claims fell 50k in Ohio alone, yet in Texas they only fell 7,400 so it seems not all states were impacted in the same way.

This means that it is difficult to come out with any firm conclusions on this report, but we suspect there will be a rebound in claims over the next two weeks. Moreover, the report highlights that as of February 6th there were 19.04mn Americans claiming some form of unemployment benefit, up 701k on the previous week and significantly higher than the 2.1mn claimants this time last year. There is still a long way to go in the recovery process.

Nonetheless, there was encouraging news from California, which like Ohio saw a 50k drop in initial claims. This is not storm related and instead reflects the ending of the stay at home orders that have allowed thousands of businesses to re-open and created revival in job opportunities in the leisure and hospitality sector.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap