US: Little jobs’ relief despite economic re-opening

Jobless claims fell, but remain extremely elevated considering the US economy is clearly on the re-opening path. With the recovery unlikely to be especially swift the pain in the jobs market looks set to linger

| 1.877m |

New US jobless claimsWeek of May 30 |

Jobless claims remain stubbornly high

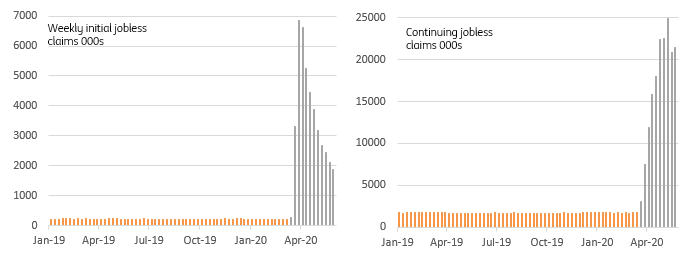

US initial jobless claims for the week of May 30 fell broadly as expected to 1.877mn from 2.126mn (consensus 1.833mn). The downward trend is obviously good news, but in the context of an economy that is re-opening it is extremely high, especially when viewed against previous recessions. It may well be that businesses that had been trying to look after their staff and keep them on the payrolls have had to capitulate. For example, social distancing constraints have made the business unviable or demand has not returned as hoped and they have been forced to adjust the numbers of staff to the new reality.

Unfortunately, continuing claims rose to 21.49 million (week of May 23) versus expectations of a second drop to 20mn. This is partly down to the way some states collect their data, but also hints, like the initial claims numbers, that the re-opening path and the impact on employment may not be as smooth as hoped.

When we look at the broadest measure of people making unemployment claims – including the Pandemic Unemployment Assistance program - we see that as of the week of May 16, and remember there is a two week lag on this versus initial claims, it fell 991,744 on the previous week to 29,965,415, but again this is going to partially reflect the distortions relating to the way some states publish their numbers. Like continuing claims, we could see it tick higher next week and for reference, we have to remember the number was just 1,534,499 in the same week of 2019 – a 28.4mn increase in 12 months

Weekly initial claims and continuing claims

Points to note for tomorrow’s “official” May jobs report

The jobless claims data only tells us information about firings, which for the survey period for tomorrow’s official report this was roughly 14 million. Unlike the April report, the re-openings getting underway in many states means that there has been some hiring in May. Yesterday’s ADP report suggesting that this was far stronger than anticipated given their number for the private payrolls decline in May was “only” 2.76mn versus a market expectation of a 9 million decline.

However, the ISM employment components for both the manufacturing and non-manufacturing sectors remain deeply in contraction territory and we have to note that the ADP number is generated by a model that includes other inputs that may have given the ADP an extra boost. We can’t dismiss the ADP report entirely, so it does look as though the current consensus for the decline in non-farm payrolls is excessive. We are minded to now look for a number closer to minus five million rather than something closer to minus ten million.

Nonetheless, the unemployment rate is still likely to rise, but perhaps not as high as the 19.5% figure expected by markets. Something closer to 17-18% now looks more probable. Finally, with the job creation presumably being focused in re-opening retail outlets and restaurants, thereby being towards the lower end of the income spectrum, the rise in average earnings may not quite as great as we initially envisaged. The consensus for a 1% MoM gain seems about right here, but we have to remember it bears no relation to reality. It is purely a statistical phenomenon as the mix of employment and the wages people earn is adjusted within the calculation.

Nonetheless, with a third of the working-age population neither employed not unemployed (early retired, students, carers, sick etc.) tomorrow's report will show less than half of 16 to 65-year-olds in work. Social distancing, consumer caution, travel restrictions and the legacy of millions of people being out of work mean the recovery will not be swift. If the unemployment rate is below 10% by the end of the year that will be viewed as a good outcome.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap