US: Jobs bonanza has much further to run

March experienced another huge jobs figure and with people movement and activity picking up strongly through 2H March we have to pencil in a 1 million plus reading for April. It's not inconceivable that all the jobs lost during the pandemic are regained before year-end, which if the case it would mean Federal Reserve rate hikes could come as soon as next year

| 916,000 |

The number of jobs the US economy added in March |

Jobs surge on weather and the re-opening

March has produced a fantastic US jobs report with employment rising 916k versus the 660k consensus with 156k upward revision to the past two months. Private payrolls rose 780k and the unemployment rate dropped to 6%.

We had been looking for a good figure as better weather in March versus February, a strong vaccination program roll out and ongoing re-opening steps being taken by the individual states lift sentiment, activity and the need for workers.

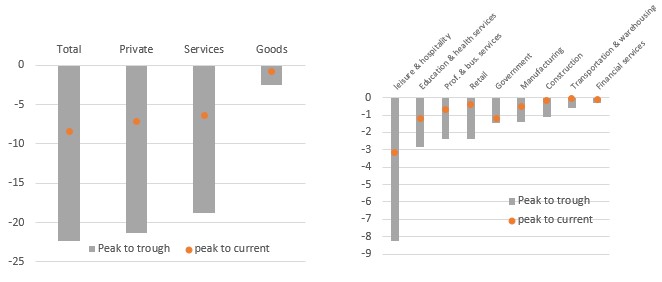

The improved weather story clearly boosted construction, which rebounded 110k and the re-opening led to a 280k gain in leisure and hospitality. Government also jumped 136k with trade and transport up 94k. Nonetheless, there is still a long way to go before the jobs market is fully healed as the charts below show employment in virtually all sectors remains below pre-pandemic peaks.

Employment is climbing back - change in payrolls peak to trough and peak to current (millions)

People are on the move and that means more work - 1 million+ jobs in April

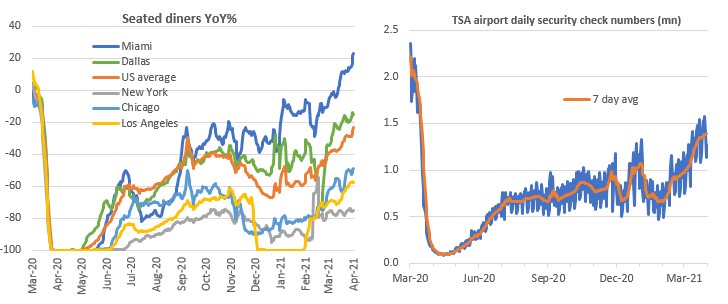

Having had the week off traveling around Nevada, Arizona and Utah, I can tell you people are out and about spending money with the $1400 stimulus payment being put to good use. Wherever I have been, restaurants have queues outside (pandemic restrictions are, admittedly, still in place) while flights are full and highways and National Parks are busy. This reinforces the evidence on dining and flight taking from Opentable and the TSA (see charts below).

With more and more movement there is more and more demand, resulting in the need for more and more workers. New York is lagging well behind on all measures, but is at least showing signs of moving in a positive direction. Given continuing upward moves in the daily restaurant and flight data through the second half of March we should be looking at jobs growth figure well in excess of 1 million in April – remember the data are collected the week of the 12th of each month so 2H March job creation shows up in April data.

Opentable restaurant data and TSA airport security check numbers point to 1million+ April figure

Fed behind the curve?

Despite this good news, we have to remember there are still 8.4 million fewer people in work than before the pandemic started. The Fed are currently signaling a first rate hike won’t come until 2024 and that they want to see “substantial further progress” before contemplating a change in their stance. Given their relaxed position on inflation it’s clear that the focus is on the jobs market returning close to its pre-pandemic state.

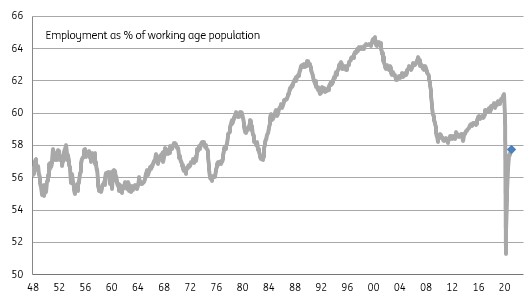

Comments from officials suggest they believe the unemployment rate is giving misleading signals given so many people have left the labour force, for reasons including having to look after people at home or no job opportunities due to pandemic-related industry closures. Consequently, the employment ratio is probably the better number to watch.

Currently just 57.8% of working age (16-65 year olds) are actually working. This is very weak as we are on a par with the early 1980s recession and when female worker participation was much lower than it is today. To get us to a jobs market that is on a similar basis to pre-pandemic levels we think the Fed would be looking for that employment ratio to get up above 60%. That requires just under 6 million more jobs being created based on the current labour force size.

Employment as % of working age population (1948-2021)

A 2022 rate hike is more likely than a 2024 first move

With a full re-opening by May/June, we believe that is achievable this year. As already outlined, we think we can see 1 million+ monthly readings in April and May before settling down in a 300-700k range for the rest of the year. On this basis there is no reason to believe that “substantial further progress” can’t be reached in 3Q. This would allow for a 4Q taper of the QE asset purchases and could conceivably open the door to a rate hike before then end of next year.

Right now, the Fed’s language isn’t there and our house view is 1H23, but the risks increasingly look skewed towards an earlier move.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap