US: Jobless claims point to record unemployment

US initial jobless claims have now risen nearly 10 million over the past two weeks. This is on its own could push the April unemployment rate up to 9.5%, but with more job losses likely in coming weeks, it will end up even higher

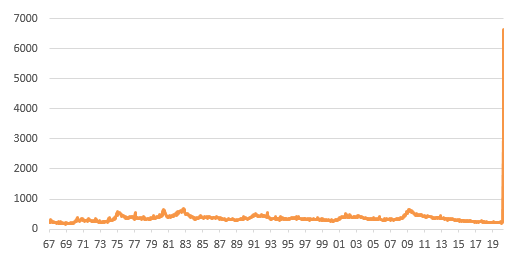

US initial claims have jumped 6.648 million in the week of 28 March after having risen 3.307 million the week of 21 March. With hiring (outside of grocery) likely to have been minimal during the two-week period, it is already indicative of the unemployment rate rising to 9.5% in April – tomorrow's March figure won’t include this due to the data cut-off in the week of 12 March (likely to be a shade under 4%). However, with more job losses likely in the next few weeks as the Covid-19 containment measures spread and intensify across more and more states, we should be braced for a 10% reading for April unemployment.

Initial jobless claims (000s - 1967-2020)

The data by state show California recording 858,000 claims, New York 366,000 claims, Pennsylvania 406,000 and Michigan posting 311,000. This is likely a delayed response to the containment measures already instigated while a backlog of claims is likely to have played a part due to anecdotal evidence of jammed phone lines and crashed websites. Staff are also likely to be overwhelmed by the number of claims, coupled with having to work from home and this may also explain why continuing claims significantly undershot expectations.

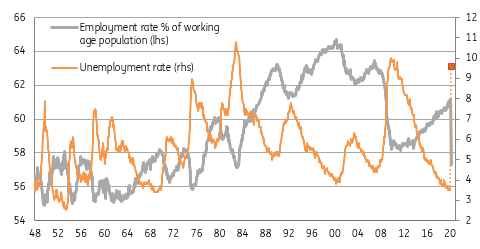

With employment plunging and unemployment surging we should be prepared for a new post-war record high in the unemployment rate. It hit 10% at the peak of the Global Financial Crisis and 10.8% in 1982. 15% is quite conceivable in May should containment measures remain in place for longer than 30 April. That said, we remain hopeful that the fiscal stimulus, with initiatives to encourage employers not to lay-off staff – will keep it below the 20% figure Treasury Secretary Mnuchin feared ahead of the package agreement.

Employment and unemployment as % of workforce with ING estimate of current position

When we finally get through the crisis and we can head on the path towards “normality”, unemployment will not fall as rapidly as it spiked. Many companies will not make it through the crisis due to the plunge in demand and others will restructure and come out requiring a smaller workforce. As such the prospect of additional fiscal support for affected households and businesses appears virtually certain.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap