US inflation surge dampens Fed rate cut odds

US inflation came in well ahead of expectations, prompting the market to dramatically reprice the prospect of rate cuts. Potential tariffs add upside risk to inflation in coming quarters, but there are some encouraging signs that housing costs will slow meaningfully later in 2025 and keep the door open to the second half of the year cuts we are forecasting

| 0.446% |

core MoM% inflation |

| Higher than expected | |

US inflation comes in far too hot

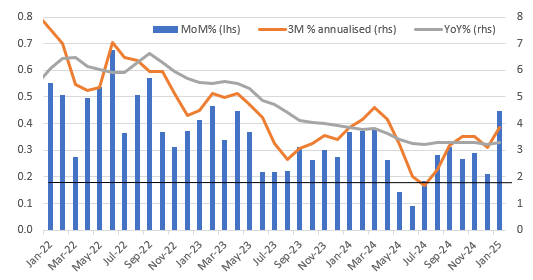

US headline inflation came in a lot hotter than expected in January, rising 0.5% month-on-month versus the 0.3% consensus. Energy prices increased 1.1% MoM so stripping out that and the 0.3% MoM increase in food prices we get a core CPI reading of 0.4%, above the 0.3% market consensus. In fact, we weren’t that far off a 0.5% print there with a 0.446% MoM outcome to 3 decimal places. The chart below shows that this is a clear deterioration from the recent trend and is the highest MoM core inflation print for two years. We need to average 0.17% MoM over time to get to the 2% year-on-year inflation target and today’s number will ensure Fed Chair Powell treads a relatively hawkish line with the House Financial Services Committee.

US core CPI metrics (% change)

Ahead of time there was a focus on how updated seasonal adjustment factors may impact the profile, but in the end this is a very, very minor detail with no material story. So, looking at the details, the standout increases are from used cars and trucks (+2.2% MoM), motor insurance (+2.0% MoM), medical care commodities (+1.2% MoM) and airline fares (+1.2%). Other areas looked much better with apparel prices falling 1.4%, medical services coming in flat and new car prices also flat on the month. Nonetheless, there is no getting away from the fact that this is a hot report and with the sense that potential tariffs run upside risk for inflation the market is understandably of the view the Federal Reserve is going to find it challenging to justify rate cuts in the near future. Our view remains that September is the most likely point for the next move lower with markets only pricing 18bp of a 25bp cut at that meeting with only 26bp priced for the whole year.

Housing costs could yet act as a counterweight to Trump's tariff threat

Longer dated Treasury yields have jumped on the back of this as the prospect of Fed rate cuts gets re-priced, but I’ll throw in one piece of potential good news on inflation for later in the year. The Cleveland Fed have done quite a bit of work looking at US rent dynamics and the impact on CPI housing components – remember primary rents and owners equivalent rent have a 42.5% weighting within core CPI. They have produced a quarterly series measuring new tenancy agreement housing costs – so when you move apartment/home – and appears to have a good fourth quarter directional lead on the main Bureau of Labor Statistics rent measures. While doing little to argue against today’s market move, it looks a potentially encouraging story for housing CPI to come in lower from late summer, which can act as an important counterweight to concerns over tariffs.

New tenant rent agreements point to a plunge in housing costs (YoY%)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap