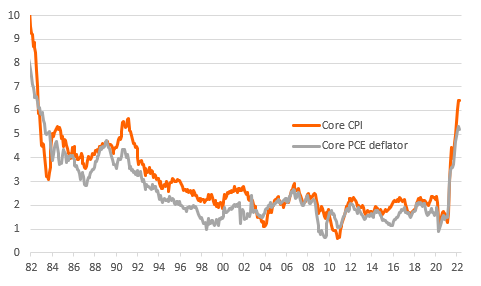

US inflation starting to climb

The 'Big 4' inflation measures that the Federal Reserve follows are all at or above the 2% target. With the economy set to grow by around 4% in 2Q18, the risks remain skewed towards a more aggressive pace of interest rate hikes in the United States

Today's release of the core personal consumer expenditure deflator shows the headline rate of inflation rising from 2% to 2.3% year on year while the core rate, which excludes the volatile food and energy components, rose to 2% from 1.8%. Both were above what the market was expecting (2% and 1.9% respectively) with both also showing the fastest rates of inflation for over six years.

This suggests that the next FOMC announcement (1 August) will need to see a more robust acknowledgement of the inflation pressures in the US economy. We expect all inflation measures to remain under upward pressure over the summer - particularly with oil prices on the rise again - with the more widely followed CPI measure likely to hit 3% in the next two to three months. Momentum is certainly to the upside given the strength of the economy and the tightness of a labour market that has the lowest rate of unemployment for 50 years.

Meanwhile, the Atlanta Federal Reserve Bank's Nowcast model, based on the recent data flow, currently suggests that real GDP growth could come in at around 4.5% for 2Q18. However, today's report showed real consumer spending for May was weaker than hoped at 0% versus the 0.2% month on month consensus. As such, we think 4.5% is a stretch, but something close to 4% looks possible. With inflation rising at such a rate, nominal GDP growth will be in excess of 6%, suggesting to us that the market remains too cautious on the outlook for Federal Reserve interest rate hikes.

US inflation measures all on the rise (YoY%)

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

29 June 2018

In case you missed it: Crunch time This bundle contains 8 Articles