US inflation - on the verge of 3%

Headline consumer price inflation rises to 2.8% in May with a strong chance it hits 3% in June. With core CPI on the rise, the Fed is set to hike tomorrow and signal two more rate increases in 2H18

| 2.8% |

US headline inflation in May |

| As expected | |

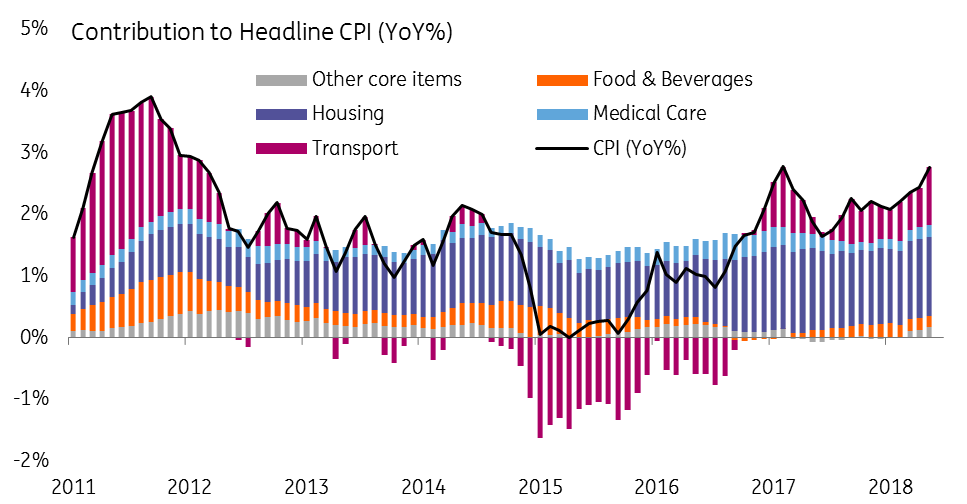

May US consumer price inflation rose 0.2% month on month and 2.8% year on year, which was in line with the market consensus while the core rate came in at 0.2%/2.2%, again, as expected.

Transport, tobacco, and housing were the main upside contributors. Gasoline prices have ticked lower so far in June, but we still think prices will be higher on average versus last month. At the same time, there are growing signs of wage pressures, which will keep nudging service sector inflation higher. Consequently, we could see 3% headline inflation in June while we expect core CPI to rise above 2.5% in 2H18.

With the economy looking set to post growth in the region of 3.5% annualised in 2Q18 – note the Atlanta Fed Nowcast model based on data already released is suggesting something close to 4.6% - and the jobs market going from strength to strength, we think the Fed will hike rates tomorrow. Trade concerns remain a major issue, but we expect the Fed’s statement to sound positive on economic momentum. Meanwhile, the Fed’s “dot diagram” should show growing expectations that it will hike rates two more times in the second half of the year, the same as we are forecasting.

US CPI contributions

Download

Download snap