US inflation edges up but still below target

US inflation misses on the downside, but price pressures will build

| 1.7 |

US Consumer Price InflationYear-on-year |

| Worse than expected | |

US consumer price inflation for July has come in at 0.1%MoM/1.7%YoY for both headline and core (excluding food and energy). This was below the 0.2%MoM/1.8%YoY predicted by the market, but we (and probably a lot of other people) had suspected the lower figure would be the likely outcome following yesterday’s softer than anticipated PPI report.

A December rate hike remains on the cards in our view.

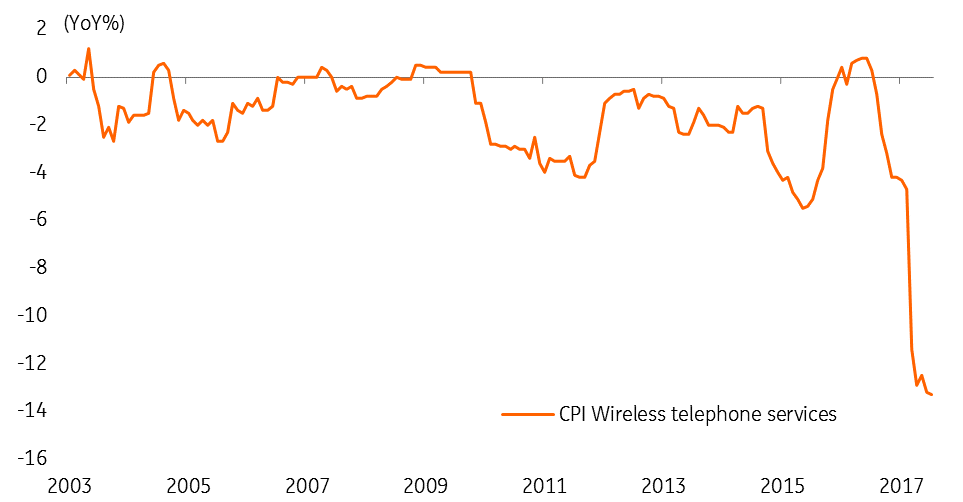

The details again showing energy prices pushed the headline rate down with transportation services also seeing price falls while housing continues its very benign run, rising just 0.1%MoM. This is also due to lower fuel and utility prices. Meanwhile, the cell phone contracts price war continues and has subtracted 0.2 percentage points from the headline annual rate of inflation.

Cell phone price war knocked 0.2ppt off headline inflation

Inflation pressures are set to build

The Federal Reserve doves will seize on this subdued headline reading as further evidence backing the case for a period of stable interest rates. Nonetheless, today's outcome ends four consecutive months of deceleration, and we think further rises in inflation are likely in the months ahead.

The 10% fall in the dollar since the start of the year will help nudge up import costs while rising commodity prices will soon see a reversal in the energy component. With the economy adding jobs and some very nascent evidence of a pick-up in wage growth we still think inflation will be back above the 2% target before the end of the year.

As such a December rate hike remains on the cards in our view.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap