US industry feels the strains

Supply chain shortages continue to hurt manufacturers with an increasing range of sectors now struggling. Nonetheless, demand remains strong with order books continuing to grow while customers become increasingly desperate. This is yet another sign the inflation pressures will be slow to fade

| 12.5% |

Decline in US vehicle production in September |

US industrial production in September was much weaker than the market was expecting. The 1.3% month-on-month fall was significantly away from the 0.1% MoM gain the consensus forecast while there was also a 0.5 percentage point downgrade to August’s figure from 0.4% growth to a 0.1% contraction. This will further dampen expectations for 3Q GDP growth, but it isn’t necessarily a terrible outcome with the hefty mining and utilities declines due to one-off weather-related factors, that will quickly reverse.

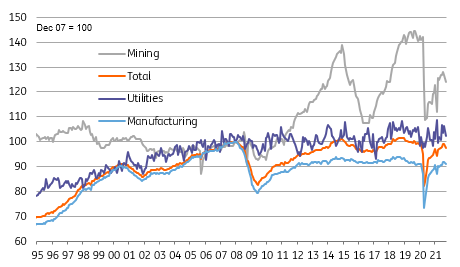

US industrial production levels by sector

The details show manufacturing output falling 0.7% with a 0.6ppt downward revision to August’s growth rate (from +0.2% to -0.4%). It was led by a 7.2% MoM drop in motor vehicle and parts (-12.5% for vehicles, -2.9% for parts) as semi-conductor chip shortages continue to heavily disrupt production lines. Outside of autos, production fell 0.3%, which suggests supply chain strains and labour shortages are not easing and will continue to hold back production for a good while yet.

Utilities output fell 3.6% due to cooler-than-usual weather leading to less electricity usage for air conditioning units. Mining fell 2.3% with disruption from Hurricane Ida impacting oil output. This isn’t great, but at least these components have scope to rebound. Indeed, oil and gas extraction will likely be a major growth driver given the surge in energy prices prompting an acceleration in drilling.

The problems for manufacturing are likely to be longer lasting with supply chain strains unlikely to ease anytime soon. Moreover, surging freight and energy costs are adding to the problems for the sector and will add to cost pressures. With demand so strong, manufacturers have pricing power and this will contribute to ongoing elevated consumer price inflation through 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap