US housing market feels the strain

The US housing market had a fantastic start to the year but Covid-19 restrictions, rising unemployment, economic uncertainty and reduced credit availability are bringing about a dramatic slowdown

Sales slowdown is just the start

US existing home sales numbers for March have come in at 5.27m, down from 5.76m in February. This was broadly in line with depressed expectations, but in “normal times” this would have been a very disappointing outcome.

Existing home sales reflect the point at which the sale is closed and given the length of time involved to complete a housing transaction it is generally viewed as a lagging indicator. However, this time it does tell us some interesting things about the post Covid-19 restricted world, indicating that the rapid closure of the economy has meant many transactions have collapsed or at the very least been delayed.

By way of background, existing home sales typically track pending home sales (reflect when a housing transaction is initiated by signing of contracts), which were at a three-year high in February. Given most transactions do not fall through there should ordinarily be a high correlation between the two series with a month or so lag.

However, at today’s point of extreme stress there is a divergence – rapidly rising unemployment forcing people to pull out of the transaction and possibly banks pulling back on credit availability – with those pending transactions in February not being finalised. The chart below reflects this story, but there is likely to be a more obvious divergence in the April data.

Existing home sales versus pending home sales

Tough times ahead for the housing market and the broader economy

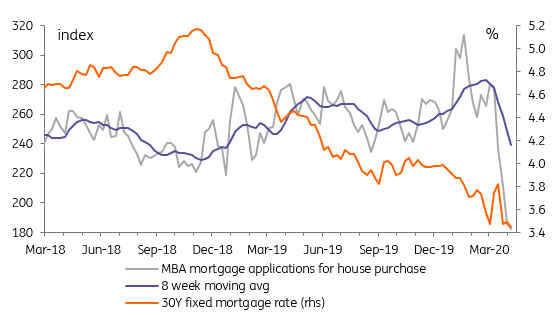

The strains are going to become increasingly apparent in the housing data. As of early April, mortgage applications for home purchases have fallen 42% since late January and are at their lowest levels since October 2015. Meanwhile, NAHB home builder confidence has plunged to its lowest reading since 2012.

With unemployment still rising and some social distancing measures likely to remain in place once the economy re-opens, home buyer demand is unlikely to return to pre-Covid-19 levels quickly. Credit availability may further constrain the housing market should rising defaults result in more wariness from lenders.

This is bad news for the broader economy. After having recorded four consecutive quarters of negative growth, residential investment grew at an annualised rate of 4.6% in 3Q19 and 6.5% in 4Q19. It is expected to have grown too in 1Q20 given very strong activity in January and February, but this is likely to mark the high-water line with residential investment subtracting from overall GDP growth through the rest of the year. Then there are obvious knock-on effects for construction jobs and retail sales tied to housing, such as home furnishing, gardening and, of course, building supplies.

This is yet another reason to doubt the prospect of a V-shaped recovery – our central forecast remains that lost economic output from the pandemic won’t be regained until mid-2022.

Plunging mortgage applications suggest slowdown will accelerate

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap