US: Growth, inflation, rate hikes

A superb ISM services report follows hot on the heels of a strong ISM manufacturing survey and a bumper jobs report. The stimulus fueled economy is bouncing back as Covid restrictions are eased. With employment and inflation pressures on the rise too, markets are right to increasingly price in the prospect of a 2022 rate hike

A new high for service sector growth

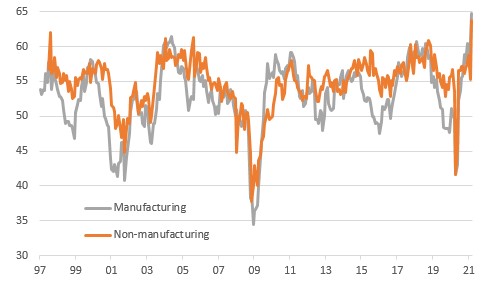

The March reading of the ISM services index jumped to a new record high of 63.7 from 55.3 – significantly above the 59.0 consensus forecast. Admittedly, the data only goes back to 1997, but it underlines the story that with Covid vaccinations proceeding well and restrictions on movement being eased, the stimulus fueled economy is taking off.

ISM headline indices

Employment and inflation gathering momentum

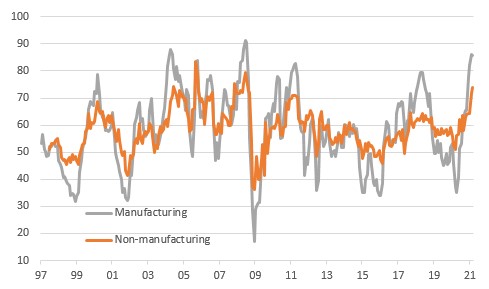

Among the key sub-components, business activity jumped to 69.4 from 55.5 and new orders rose to 67.2 from 51.9 with employment at 57.2 versus 52.7 in February – the number corresponds to the % of respondents replying positively and half of the percentage of respondents saying things are the same as last month.

Inflation pressures also continue to rise with prices paid at the highest level since 2008. This is the same message we got from the manufacturing ISM index last week and shows that the US economy is broadly bouncing back across all sectors.

ISM prices paid components

It also suggests that last Friday’s 916,000 increase in employment will likely be beaten in April with more spending and more people movement requiring more jobs to meet the demand. We expect to see 1 million plus monthly job gain readings through to June as Covid containment measures are eased further.

Tough questions for the Federal Reserve

With today’s report offering more evidence of accelerating activity, strengthening jobs creation and rising price pressures a late 2022 rate hike looks increasingly likely. Remember too that this is before the economy feels the full effects of the Build Back Better program announced by President Biden last week.

The Federal Reserve’s June FOMC meeting will inevitably require significant revisions to the Fed’s own forecasts. For now the Fed’s dot plot has the first rate hike coming in 2024, but that is increasingly difficult to reconcile with the data flow we are currently seeing.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap