Watch for a 7% US growth rate despite durables’ set-back

US durable goods orders growth slowed sharply in March as semi-conductor chip shortages constrained key manufacturing sectors. Nonetheless, the stimulus fuelled consumer sector provides strong underpinning and both residential and equipment investment will contribute positively to what looks likely to be a very strong first-quarter GDP figure

Durables disappoint as chip shortage bites

March US durable goods orders are weaker than expected, rising 0.5%MoM versus the consensus forecast of 2.3%. There are upward revisions to the history, but it still classifies as a downside miss.

The weakness is concentrated in the transport section (-1.7%) with the semi-conductor chip shortage leading to well-publicised production cut-backs at automakers. This is resulting in fewer orders for other vehicle components. The electrical equipment component (-1.5%) is suffering for the same reason.

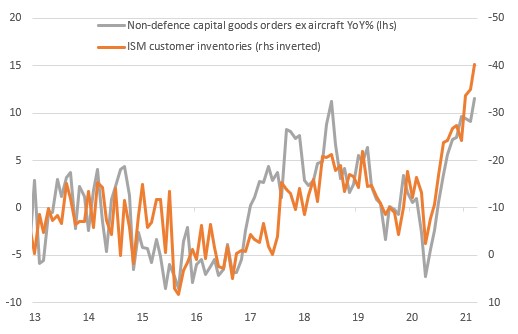

They will recover as the chip story improves along with the fact the ISM reports a net 40% of respondents currently saying that their customers’ inventories are "too low". This also means we should expect much stronger order numbers through 2Q into 3Q.

Low customer inventory levels will continue to support strong manufacturing orders

But low customer inventory levels point to a rebound

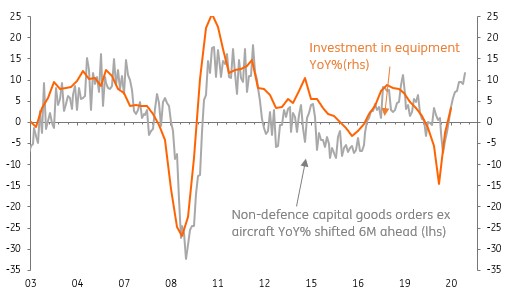

Outside of transportation and electrical equipment, the orders numbers already look very strong. As the chart below shows, the non-defence capital goods orders excluding aircraft – a “core” measure that is considered a good proxy for capital expenditure by US businesses – point to a strong first-quarter investment reading.

Strong orders point to big investment contribution to 1Q GDP growth

1Q GDP will be strong, 2Q even better

Stimulus payment fueled consumer spending, coupled with robust residential construction activity resulting from a red-hot housing market will give 1Q GDP growth strong foundations. On top of this, there is a rebound in oil and gas drilling on higher prices, while durable goods orders point to a very healthy contribution from investment in equipment and software.

The main drags will be inventory rundowns due to supply chain issues, tied to the same semi-conductor chips issue. Net trade will also subtract from headline growth as strong consumer spending sucks in imports while weaker growth elsewhere will limit export growth.

On balance we see the risks to 6.5% consensus forecast as being to the upside and forecast 7.4% annualised growth. 2Q 2021 should be even stronger as the re-opening gathers increasing momentum.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap