US confidence slides as Covid and inflation fears rise

The Conference Board measure of confidence has fallen to a six-month low as worries about Covid's resurgence and the impact of inflation on spending power make households more nervous. It looks increasingly likely that consumer spending has stalled in 3Q, but a strong labour market and decent household finances offer hope that this will be temporary

Covid and inflation make households nervous

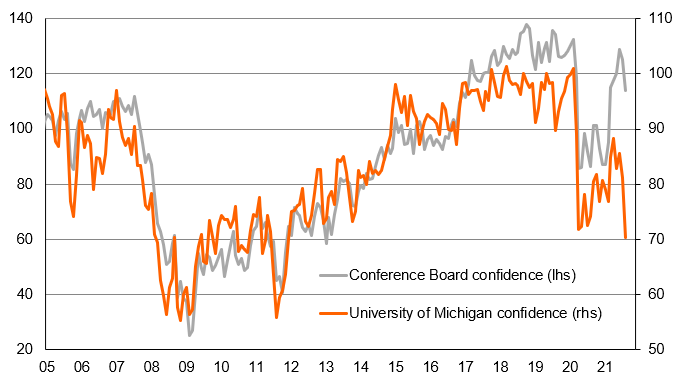

Given the August University of Michigan measure of consumer confidence posted the seventh largest individual monthly fall on record we were a little unsure as to why the consensus was looking for only a modest fall in today’s Conference board measure of confidence. In the end it dropped from a downwardly revised 125.1 to 113.8 – well below the 123 consensus.

As the chart below shows in relative terms it isn’t as bad an outcome as the University of Michigan measure, but it still tells us that the resurgence of Covid and higher inflation readings are making consumers much more wary. This was particularly evident in the expectations component that fell 12.4 points while current conditions fell a more modest 9.9 points.

US consumer confidence measures

Spending set to slow

The regional breakdown also has some interesting outcomes. East South Central America, where there have been some major Covid hotspots saw the biggest declines in confidence (24 points). West South Central and the Mountain region of the US actually saw confidence rise! Most other areas fell broadly in line with the national average.

We can already see a slowdown in restaurant bookings and air passenger traffic and this suggests less leisure and hospitality activity in general as people movement slows in response to Covid case increases. Meanwhile, inflation expectations have risen as a response to higher gasoline and food prices and this is sapping confidence as households worry about their spending power. Expectations for car, home and appliance buying all declined this month.

Daily air passenger numbers at airport security checks

Reasons for optimism remain strong

With retail and auto sales having fallen sharply, the broad declines in consumer sentiment suggests consumer spending will struggle in the near term. We suspect that we will see a small contraction in 3Q consumer spending, but remember this follows on from the stimulus check fuelled spending surge in 2Q. Rising business investment will more than offset this though and we still expect to see a decent 3Q GDP growth rate of a little under 5%.

Looking further ahead, Covid case numbers are showing signs of topping out so we think that confidence will gradually recover, especially given jobs continue to be created in significant number and wage rates are rising given the competition for workers. We also have to remember credit card balances have been shrinking and cash and savings deposits have risen substantially through the pandemic. This should provide a decent platform for activity in 4Q and into 2022.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap