US: Business getting back on track

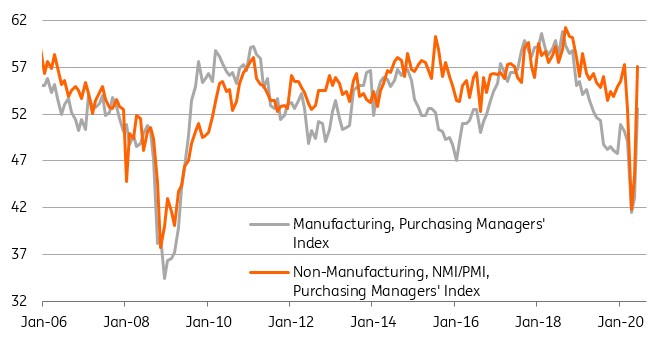

A sharp rebound in the ISM business surveys is another positive development, but remember the series don't tell us anything about magnitude. All we can fairly say is that a majority of companies are now experiencing an expansion after a torrid few months. The employment components do remain a worry though…

The June reading for the ISM non-manufacturing survey has posted a very big bounce to 57.1 from 45.4, which was well ahead of the consensus forecast of 50.2. This is a diffusion index centred on 50, so it tells us that a majority of businesses in the service sector are experiencing an expansion in activity versus May. Given the re-opening of the economy we should surely have expected to see some form of economic expansion after a terrible couple of months.

Unfortunately it doesn't tell us the magnitude of the expansion, only the changes in activity, since the survey response are limited to "things are getting better/staying the same/ getting worse". Activity may well have halved between February and May, but if a majority of companies experience even a 1% rise on that May level you get an above 50 (expansion) reading. Therefore we would caution that you can get some very big swings in the index reading during periods of stress, but it doesn't provide clarity on how big the hit to economic output is.

The index is calculated by adding the proportion of respondents that are saying things are getting better to half of the proportion of people responing "the same". So for example, if 20% are responding things are getting better, 65% are saying things are the same and 15% say things are getting worse the index is 20+65/2 = 52.5. We have no way of knowing how big the expansion is from this figure.

As such, we wouldn't place too much emphasis on this report as it simply can't quantify anything for us, but for what it is worth, the major order and output components rose significantly.

Unfortunately the same can't be said for employment. It remains in contraction territory at 43.1 with the details showing 25% of respondents reporting smaller workforces. This is troubling given high frequency indicators are suggesting the rate of lay-offs remains extremely elevated (jobless claims) while the Homebase survey suggests jobs are also being lost in the small business sector. With many states dialling back on the re-opening strategies and others putting theirs on hold there is clearly the risk that the apparent vigour of the initial economic rebound may soon start to moderate – especially if the government chooses not to extend the emergency unemployment benefits that are due to expire at the end of this month.

Headline ISM manufacturing & non-manufacturing series

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap