UK spending splurge could have further to run

The latest surge in UK retail sales does sound a little too good to be true, but either way, spending could continue to modestly improve as Brexit uncertainty temporarily dips. But given the challenging outlook for investment, we don't expect the Bank of England to hike rates this year

Despite all the Brexit noise, the latest surge in UK retail sales indicates consumer spending performed a little bit better during the first quarter – at least at face value. At 6.2% year on year, retail sales excluding fuel are now growing at the fastest annual pace, since the end of 2016.

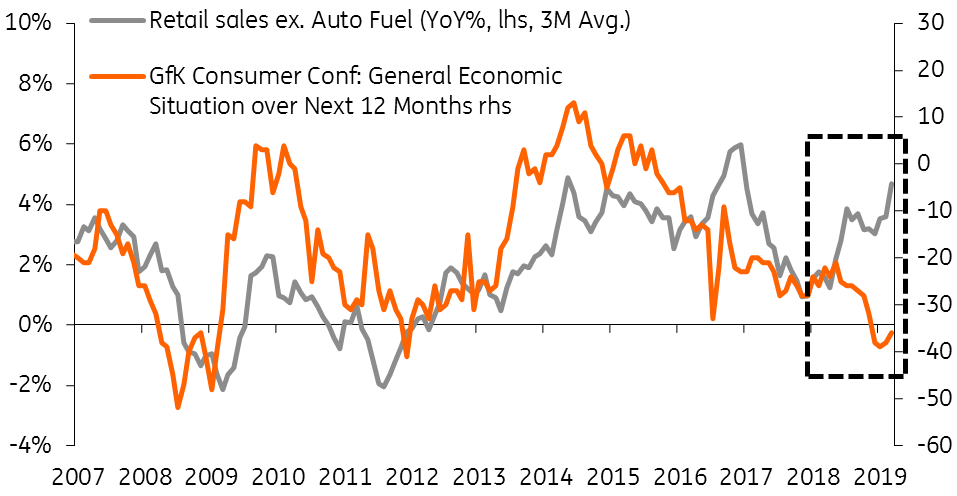

However, we think it’s worth treating these latest figures with a touch of caution. Easter falls later this year, which might typically be associated with lower sales during March relative to other years. Similar data from the British Retail Consortium also suggested that spending was more muted during March, aside from some increased purchases related to Mother’s Day. The latest surge in retail spending also comes at a time where consumer confidence is around the lowest it has been since 2013.

A gulf is opening up between better spending figures and depressed consumer confidence

That said, we think consumer spending could continue to perform well in the near-term. The latest Brexit extension to the end of October could see consumer confidence rise a little over the next couple of months as some of the ‘no deal’ concerns temporarily dissipate. That, combined with prospects of a sunny Easter trading period, makes for a better backdrop for retailers as we head towards the summer.

This could see a bit of growth momentum return in the short-term, although we suspect overall economic activity will continue to be restrained by the challenging investment environment. With Brexit uncertainty set to return again as we move through the summer, we think it is unlikely that the Bank of England will hike rates again this year.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap

18 April 2019

In case you missed it: China to the rescue? This bundle contains 10 Articles