UK retail activity rebounds after weather-distorted March

The year-long retail recession we saw in 2022 looks increasingly like it’s over, and with real wage growth set to become less negative, the worst is probably behind us for the sector

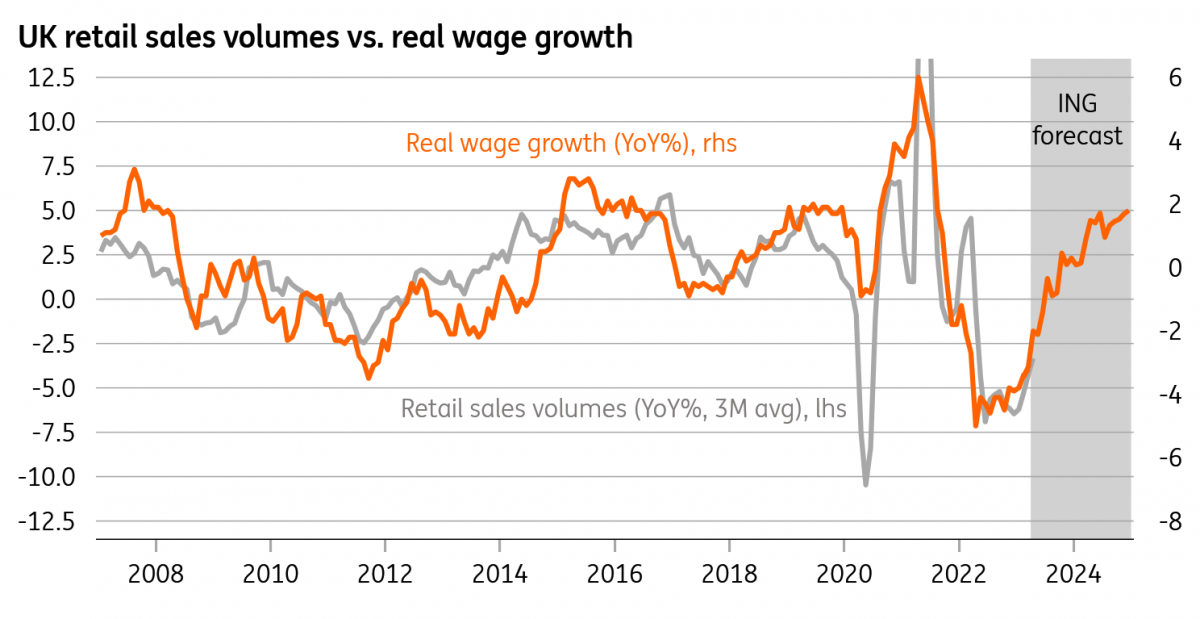

After a rain-battered March, UK retail sales rose by 0.5% in April, partially offsetting the weakness seen in the prior month. And more importantly, the year-long retail recession we saw in 2022 looks increasingly like it’s over. Sales are up fractionally since December’s trough, and the worst is probably behind us for retailers. Real wage growth – measured crudely as regular pay growth adjusted for headline inflation – is set to become much less negative over the coming months as energy prices fall but nominal pay growth proves sticky. Consumer confidence has also begun to recover.

None of this points to an imminent recovery in the level of retail activity. The well-publicised fall in gas prices, together with consistent and very visible falls in petrol prices on forecourts probably explains a lot of the recovery in confidence. But food prices continue to rise unabated, and these will act as a key constraint on household budgets – particularly those on lower incomes – over the next few months.

The worst is probably behind us for retail sales

In the very near term, we may get some extra volatility in retail sales surrounding the King’s Coronation earlier this month – though experience from the extra bank holidays in 2022 suggests that extra food sales could help counterbalance weakness from temporary shop closures. Overall, we expect monthly GDP to contract by half a percent in May (to be fully recovered in June).

None of this is of much consequence for the Bank of England, which now looks poised to hike rates once again in June after those unhelpful inflation figures this week. While some unusual (and probably temporary) moves in certain components drove some of the upward surprise in core CPI, it nevertheless puts policymakers in an awkward situation.

We doubt the committee would endorse the recent move in market pricing, which has more than 100bp of additional tightening priced in. The level of rate expectations for later this year (circa 5.5%) and the spread on future rate expectations between the UK and the US is now not dissimilar to what we saw around the time of the BoE’s November 2022 meeting, when it cautioned that market pricing looked overstretched.

But given the tendency for the inflation numbers to outperform expectations recently, we doubt the Bank will attempt to push back too hard against these expectations right now. We still get another round of data before the June meeting so we’ll reserve full judgement until then. But for now, we expect another hike in June without much pre-commitment on future steps.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap