UK jobs data hints trouble could lie ahead for wage growth

UK wage growth is close to post-crisis highs, but some tentative early warning signs suggest that the jobs market is entering a turbulent period. We don't expect a rate hike from the Bank of England this year, although recent comments from Governor Carney suggest a November move shouldn't be ruled out

At 3.3%, UK regular pay growth is continuing to rise at a rate close to its post-crisis high. The question is: can this strength persist through 2019 – and in fact, will wage growth gradually accelerate towards 3.5 - 4% as the Bank of England expects?

Well, in principle there are few reasons to expect an imminent or sharp slowdown. The recent acceleration in pay growth has been driven by rising skill shortages across the economy, particularly concentrated in sectors such as construction and hospitality. Some of this is undoubtedly down to the lagged effect of earlier economic strength, but equally, there are a number of structural factors driving shortages of skilled labour which are unlikely to disappear rapidly. For instance, a chronic shortage of lorry drivers has been caused by demographic factors and is this is forcing haulage firms to offer higher wage rates for certain shifts.

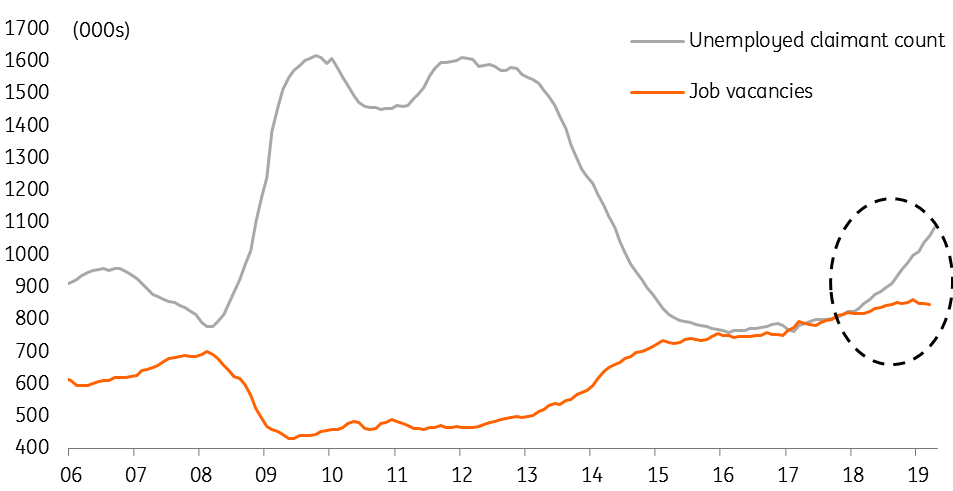

Unemployed claimant count diverging from number of vacancies

For the time being then, higher wage growth, coupled with benign inflation, should give consumer spending a modest boost over the next few months. Amid all the uncertainty though, there are some early warning signs emerging from the jobs market. Employment growth has slowed since the start of the year, which tallies with various survey indicators that have hinted at reduced appetite to hire – particularly full-time positions. Meanwhile, the number of people on the unemployed claimant count has been gradually rising, and now noticeably exceeds the number of job vacancies. While there are various caveats with using this measure of unemployment, it does hint at a margin of slack opening up.

Having said all of that, it’s still early days and for the time being, we don’t expect any of this to change the Bank of England’s positive outlook on wage growth. We don’t currently expect a rate hike this year, but following some recent hawkish comments from Governor Carney, we wouldn’t completely rule out some further tightening in November if either a Brexit deal is ratified, or more likely, Article 50 is extended further.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap