UK inflation set to fall below 2% by May after latest data

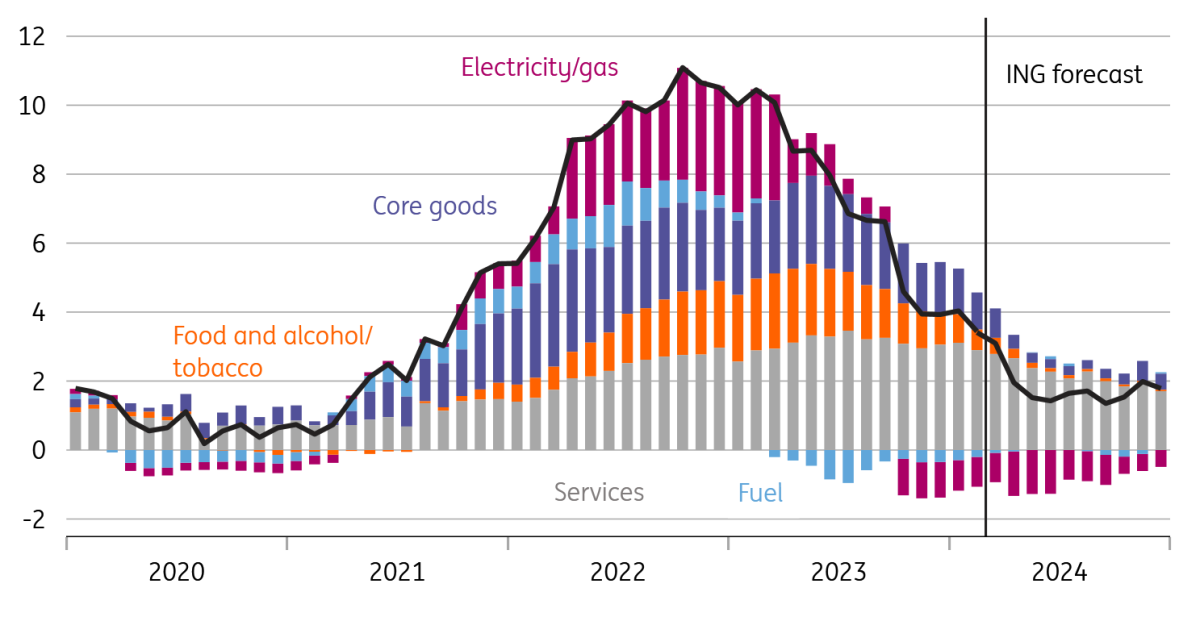

February's inflation data showed further progress across the board, and the prospect of sharp falls in energy bills in April and July suggests headline CPI will be below 2% from May and for much of 2024

UK inflation continued to head in the right direction in February and slipped further than expected to 3.4% from 4.0% a month earlier. A lot of this can be explained by food inflation, which is falling rapidly. On a month-on-month basis, producer prices for food have either been flat or slightly negative for a while now and that’s feeding through to consumers very noticeably. The annual rate of food inflation now sits at 5% and we think that could be below 1% by June.

That, together with further downward impetus from ‘core goods’ categories, and of course a 12% fall in household energy bills due in just under two weeks, should take headline inflation below 2% in either April or May. It’s likely to stay below the Bank of England’s target for much of 2024, especially when you consider we may well see another double-digit percentage point fall in energy bills in July when the regulator again updates the household price cap.

Contributions to UK inflation and ING forecasts (YoY%)

For the Bank of England though, the focus is almost entirely on services inflation where the progress has been more steady. Services CPI did slip from 6.5% to 6.1% in February, which though a tad above consensus, is bang in line with the BoE’s most recent forecast. We saw another very strong month of rental inflation, which is helping to mask more noticeable progress elsewhere in areas such as catering. The committee expects services inflation to fall to the 5% area by early summer, a forecast that looks pretty similar to our own.

That said, both 2022 and 2023 saw huge price rises across service-sector categories during the second quarter, mainly linked to annual contractual price rises. These add a certain degree of unpredictability to the data and we think the BoE will want to have the inflation figures for April and May in hand before doing anything on interest rates.

If the services inflation and wage growth data surprise to the downside ahead of the June meeting, then there’s a chance we get a rate cut at this point. But more likely we think the committee will wait for a few more numbers and also a new round of forecasts, which makes August a more likely candidate for the first rate cut.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap