UK inflation resurgence points to final 25bp rate hike this week

January's dip in services inflation seems to have been a temporary one, and the bounceback in core CPI in February is unwelcome ahead of the Bank of England's meeting this week. We expect a final 25bp hike on Thursday

| 10.4% |

Headline inflation in February, up from 10.1% in January |

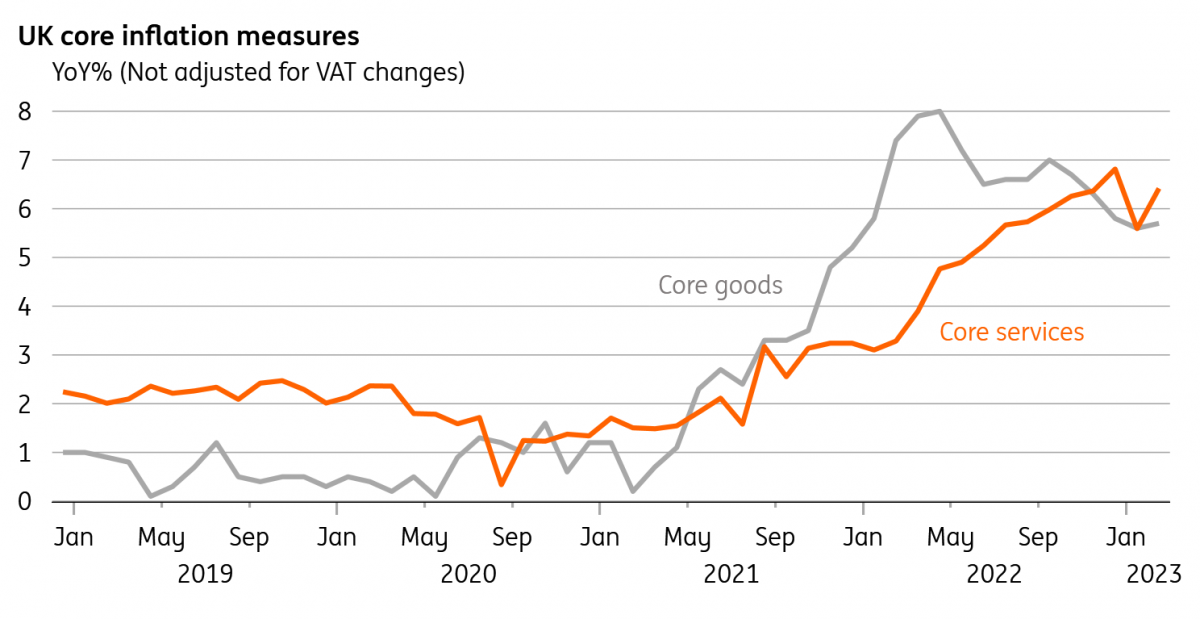

A day before the Bank of England announces its latest decision, it is faced with an unwelcome resurgence in UK core inflation. Core CPI is back up at 6.2% (from 5.8% in January), and more importantly shows that the surprise dip in services CPI last month was a temporary one.

Policymakers have signalled this is an area they’re paying particular attention to, not least because service-sector inflation tends to be more ‘persistent’ (that is, trends tend to be more long-lasting than for goods) and less volatile. Inflation in hospitality is proving particularly sticky.

The caveat here is that the Bank has indicated it is paying less attention to any one single indicator, and is focused more on a broader definition of “inflation persistence” and price-setting behaviour. And in general, the data has been encouraging over the past month or so. The Bank’s own Decision Maker Panel survey of businesses points to less aggressive price and wage rises in the pipeline, and the official wage data finally appears to be gradually easing.

Core services inflation has bounced back after January's dip

We suspect the Bank will want to see more evidence before ending its rate hike cycle entirely, and that’s particularly true after these latest inflation numbers. We’re still narrowly expecting a 25bp hike on Thursday, and we think the BoE will take a leaf out of the European Central Bank’s book and reiterate that it has the tools available if needed to tackle financial stability, thereby allowing monetary policy to focus on inflation-fighting. This was the mantra it adopted last October/November during the mini-budget and LDI pensions fallout in UK markets.

However, assuming the broader inflation data continues to point to an easing in pipeline pressures, then we suspect the committee will be comfortable with pausing by the time of the next meeting in May.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap