UK housing market dampens like British weather

The weather isn't the only miserable thing at the moment in the UK, the property market seems to be in a similar state too

It isn’t just the British weather that is damp and miserable at the moment. The property market is also looking in an increasingly sorry state, which will act as another reason not to hike interest rates.

The housing market, like most of the UK economy, held up well in the immediate aftermath of the Brexit referendum result last year, but things seem to be getting pretty bad now – particularly in London and the South East.

RICS takes note

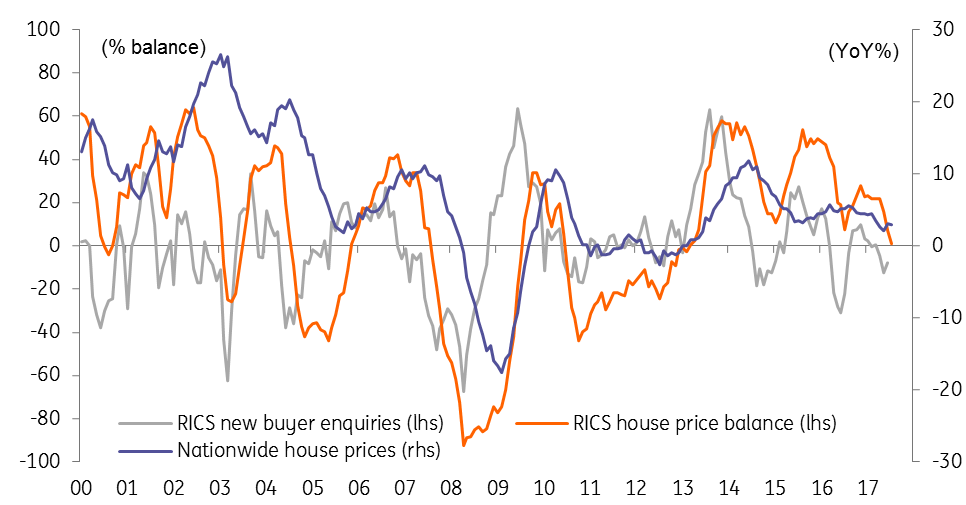

According to the Royal Institution of Chartered Surveyors, the balance between the proportion of surveyors seeing house price rises to those seeing house price falls has dropped to just 1% - the weakest reading since February 2013. In London the story was far worse with the balance dropping to -48% while for the south east it stands at -24%.

Given these property markets saw the biggest price rises after the financial crisis are now seeing the largest falls perhaps isn’t a surprise, but the scale of it and the fact that 68% of homes priced at more than £1 million are selling below the asking price perhaps is.

UK housing market is cooling

Brexit uncertainty at play

The pessimism is certainly spreading across the country with price expectations amongst estate agents falling to its lowest level since the immediate aftermath of the referendum outcome. The uncertainty over Brexit, the strain on household finances, the warning over excess credit growth and the general hit to confidence are all combining to present a weaker outlook for the property market.

Also, we have to remember there have been major changes to stamp duty. This is at both the top end of the market were properties over £937,500 have seen a sharp increase in the tax to be paid and more towards the bottom where buy-to-let investors are faced with an extra 3% of the property price charge.

However, with strong employment levels substantial falls in property prices look unlikely as people aren’t forced to sell, instead, we expect a general drift lower.

But a weaker housing market still has broader implications: lower stamp duty receipts for the government, weaker retail sales particularly for home furnishings and we have to remember how important the housing market is for confidence, given high home ownership rates in the UK.

As such, it is yet another reason for the Bank of England to keep rates on hold.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap