The freefall of Hungary’s industry continues

After January’s very disappointing performance, industrial production did not rebound in February. Thus, the full-year outlook for Hungarian industry is getting gloomier by the day

| -4.6% |

Industrial production (YoY, wda)ING estimate -0.6% / Previous -3.3% |

| Worse than expected | |

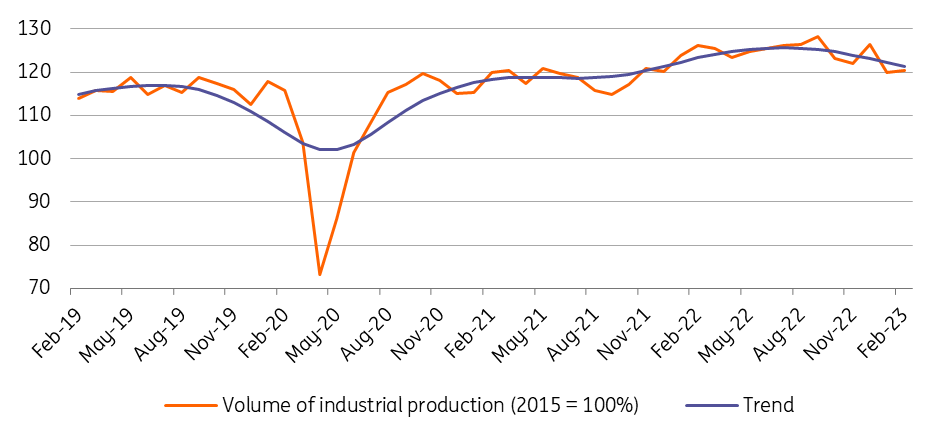

Hungary's industry continued to underperform in February, as the volume of industrial production fell by 4.6% year-on-year (YoY). The magnitude of the downturn remains the same after adjusting for calendar effects, but such a large yearly drop was observed only during the darkest days of Covid. However, at the time the distressing performance was due to obvious reasons, but now the reasons are less clear.

The grim yearly based performance is the result of a 0.3% month-on-month (MoM) increase in the volume of industrial production, after adjusting for seasonal and calendar effects. Nevertheless, February’s slight rebound was following January’s very disappointing performance, thus the volume of production has been 2.4% lower so far in 2023, compared to the first two months of 2022.

Performance of Hungarian industry

Even though the Hungarian Central Statistical Office (HCSO) will only release the detailed data next week (13 April), the preliminary statement highlights that the majority of the manufacturing subsectors contributed to the production decline. Just as back in January, the only silver linings were electrical- and transport equipment manufacturing (e.g. EV batteries and cars), which both expanded on an annual basis in February.

On the other hand, the volume of production fell in the manufacturing of computer, electronic and optical products, along with the manufacture of food, beverages, and tobacco products. The latter does not come as a surprise, given that the volume of sales in this particular sub-sector has been contracting since June 2022 on a yearly basis, as we pointed out in our last note.

In essence, only the industrial output related to the automotive sector can breathe any kind of life into Hungary's industry. What’s more interesting is that HCSO has highlighted for the first time since the pandemic, that “the majority of the manufacturing subsections contributed to the production decline”, which indicates broad-based weakness. At this point, even the over-performance of the automotive sub-sector cannot counterbalance the fact, that most of Hungary's industry is struggling amid an ongoing technical recession.

Moreover, the average monthly mean temperature in February was 1-2 degrees colder than a year earlier. In fact, this would have boosted the production of the energy sector in previous years. However, the Hungarian government restructured the overheads protection scheme last summer, with the balance tilted towards supporting more conscious energy usage. Against this backdrop, the difference in temperature did not result in higher energy consumption, and this time, the energy sector may have been more of a drag on the performance of Hungarian industry.

We had hoped that as global energy prices retreated, we can see a stark rebound in overall industrial performance, but the reality may be that only the larger industrial firms have been able to negotiate favourable energy contracts. This would mean, that smaller firms may be stuck with energy contracts that do not follow the price of TTF natural gas, which was below EUR 60 for the whole month of February.

Volume of industrial production

As we continuously pointed out in our latest notes, the predictive power of the Hungarian PMI reading, and the business confidence indicator have been deteriorating for some time. Since October 2022 each PMI release came in above 55 with the latest print in March being 55.3, indicating an ever-expanding industry. Against this backdrop, the hard data’s monthly dynamics have disappointed since October except for December.

Nevertheless, with February’s 56.5 PMI reading, which was followed by a -4.6% YoY decline in industrial performance, we can say that this soft indicator is unreliable at this point of the cycle. In our view, the reason behind the divergence is due to the over-representation of more significant sectors and larger producers relative to smaller manufacturers. However, the positive performance of the auto industry is amply offset by the declining performance of the smaller, more energy intensive sectors being prone to domestic demand, as recent developments clearly reflect.

Manufacturing PMI and industrial production trends

Going forward, the full-year outlook for Hungary's industry is getting gloomier by the day, due to both internal and external factors. The ongoing technical recession clearly dampens demand, as the domestic order book of firms is continuously contracting. On the other hand, the export outlook is also deteriorating, as the likelihood of a US recession and worse-than-expected Chinese growth increases. With these risks in mind, we believe that the likelihood that our latest 0.5% full-year industrial performance forecast in 2023 will not be met, has just increased.

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap