The Commodities Feed: Zinc spread flips to contango

Your daily roundup of commodity news and ING views

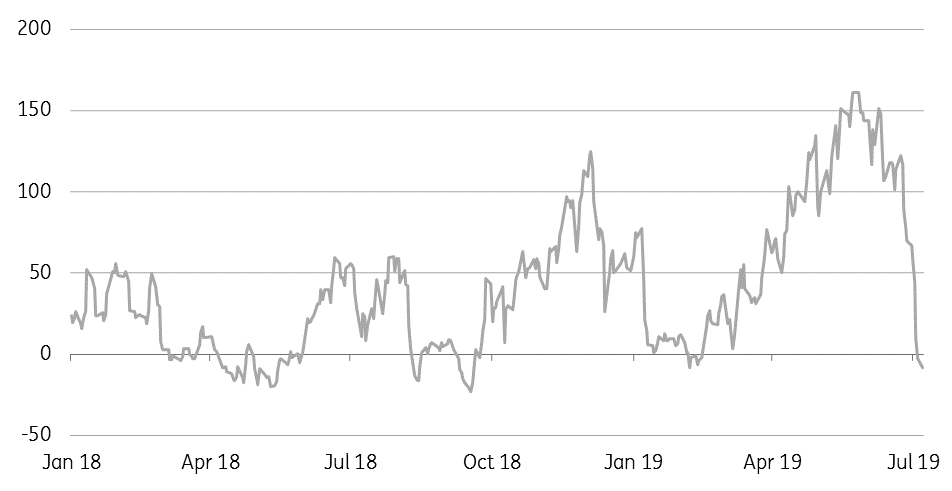

LME zinc cash/3 month spread flips to contango (US$/t)

Energy

US inventories: The API is scheduled to release its weekly US inventory numbers later today, and expectations are that US crude oil inventories declined by around 2.55MMbbls over the last week, according to a Bloomberg survey. On the product side, expectations are for a 2.2MMbbls draw in gasoline inventories, whilst distillate fuel oil stocks are expected to increase by 800Mbbls over the week. The gasoline draw is likely to be driven by the east coast, with the region seeing stocks fall from the five-year average at the start of June to more than a five-year low as of last week. Given the PES refinery closure, along with stronger 3Q demand, we would expect stocks to remain tight, which should continue to offer support to the RBOB crack.

Forties oil flows reduced: Ineos provided an update on the progress of repair work at one of its processing units, which has seen them reduce oil flows along the Forties Pipeline System to around 180Mbbls/d. These flows are expected to be reduced to 150Mbbls/d. Initially the pipeline was expected to return to full operation by mid-day Tuesday, however Ineos now expects operations to return to normal sometime between Wednesday and Friday.

Metals

Zinc spreads: The frontend of the LME zinc forward curve has swung into contango despite stocks still pointing lower. The cash-to-three month spread has fallen into a small contango of $8.50/t. With smelters in China picking up the pace and demand entering a seasonal lull, the speed of destocking has significantly slowed. The total inventory level from major cities (Shanghai, Tianjin, Guangzhou) has been hovering around 150-160kt over the last few weeks, struggling to move lower. In the medium term, zinc demand may find support from China’s car market, which showed signs of recovery over June, and there are now wider expectations for infrastructure spending to increase over the remainder of the year. This is likely to give a boost to market sentiment before real impacts take effect.

Nickel spreads: While LME nickel stocks continue to move lower, the cash-3M contango has narrowed from around $90/t a week ago, to $44/t as of yesterday. There has been a large drawdown in full plate cathode over the weekend, and an earthquake on Sunday on the northeastern coast of the island of Sulawesi in Indonesia has raised concerns over potential supply disruptions from the country. According to industry sources, as of yet there has been no impact to ore shipments.

Agriculture

US crop progress: The latest crop progress report from the USDA continues to highlight concerns for US crops. Over the last week soybean plantings were 96% complete, up from 92% the week before, although by this stage last year plantings were already fully complete. However it is the crop condition which is a concern, with the agency rating 53% of the crop in good to excellent condition, which compares to 71% at the same stage last year. Meanwhile, 57% of the corn crop was reported to be in good-to-excellent condition, which is down from 75% at the same stage last year. Heavy rainfall over much of the planting period, which delayed planting, has had an impact on the condition of these crops.

Looking ahead, the USDA will release its monthly WASDE report on 11 July, and expectations are that we could see downward revisions to US yields, and as a result production. A Bloomberg survey shows that the market expects corn yields to fall to 164.8bu/acre compared to a June forecast of 166bu/acre, resulting in production falling from 13,680m bushels to 13,578m bushels. Similarly, expectations for soybean yields are for them to fall from 49.5bu/acre to 48.5bu/acre, resulting in production declining from 4,150m bushels to 3,866m bushels.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap