The Commodities Feed: WTI/Brent discount narrows

Your daily roundup of commodity news and ING views

WTI/Brent spread vs. US crude oil exports

Energy

WTI/Brent discount narrows: The WTI/Brent spread continued to narrow yesterday, with the discount reaching US$6.68/bbl- levels not seen since August. The relative strength in WTI comes somewhat as a surprise given that US crude oil inventories have remained stubbornly high- both total US commercial crude inventories and stocks in Cushing. For Brent, OPEC cuts have tightened up the market- evident in the steepening backwardation of the Brent forward curve. Growing tension in Libya only adds further uncertainty to supply moving forward. Much further strength will likely weigh on US crude oil exports. In fact, US exports have already fallen from their weekly high of 3.6MMbbls/d in mid-February (a time when the WTI/Brent discount was around US$10/bbl) to around 2.7MMbbls/d in the last EIA weekly report.

Later today, the API releases US inventory numbers and market expectations are that US crude oil stocks increased by 2.5MMbbls over the last week, according to a Bloomberg survey. On the products side, the market is expecting to see a 2MMbbls and 1.5MMbbls decline in gasoline and middle distillate inventories, respectively.

Pernis refinery strike: The products market in Europe could find some support with strike action at the 400Mbbls/d Pernis refinery in the Netherlands starting on Monday. Shell has confirmed that production will be affected whilst the trade union has said that production will be reduced to 65% of capacity. Strike action is expected to last until Wednesday evening. The ICE gasoil crack has been under pressure since early March (trading from US$18/bbl to just over US$13/bbl currently), with ARA inventories moving back towards the five-year average. However, prolonged disruption at the refinery would be supportive for the crack.

Metals

China iron ore inventory: Latest data from Steelhome shows that iron ore inventories at Chinese ports increased by 1.3mt over the last week and as a result, stocks have reached a six month high of 148.9mt. The inventory build-up (+11.1mt over the past two months) comes despite lower supplies from Australia and Brazil and suggests that demand is likely under pressure– with relatively low margins for steel producers.

However for iron ore supply, disruptions continue to arise. Rio Tinto has confirmed a fire broke out at its screening facility at East Intercourse Island, which is part of its Dampier port operations in Pilbara. Operations have partly restarted at the facility.

WASDE report

WASDE report: The USDA is set to release its latest WASDE report later today. Expectations from the market are for US 2018/19 ending stocks to be revised higher from the March report. Corn is expected to see the biggest percentage increase, with the market expecting ending stocks to increase by 8% from the March estimate to 1.99b bushels. For the global balance, it is a similar picture, with the market expecting the USDA to increase ending stocks for corn, soybeans and wheat.

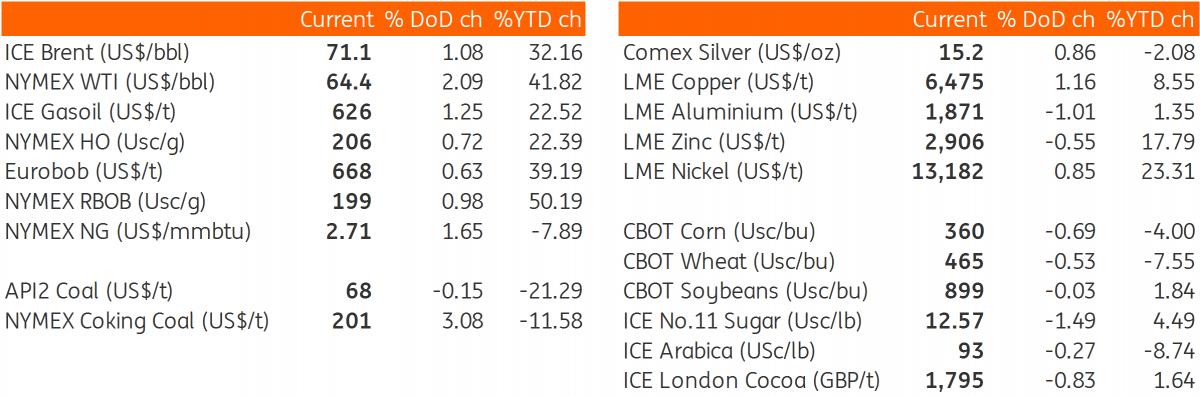

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap