The Commodities Feed: When will OPEC+ meet?

Your daily roundup of commodity news and ING views

Energy

The relentless move lower in oil prices continued yesterday with ICE Brent settling more than 2.5% lower and taking it to levels last seen in early October. That said, the market has witnessed a bit of a bounce in early morning trading today. That could be because the World Health Organization (WHO) has suggested that significant restrictions in travel and trade were unnecessary, despite declaring a global health emergency. The Commitment of Traders report, which will be out later today, is likely to show a sizeable liquidation of speculative longs in both ICE Brent and NYMEX WTI, as demand fears in the market continue to linger. There is growing noise around OPEC+ bringing forward their extraordinary meeting from early March to February as a result of the coronavirus developments. According to media reports, Saudi Arabia is keen to meet earlier than scheduled, whilst the Russians are more reluctant to do so. Further downward pressure on prices may speed up the decision on whether to have the meeting in February or not.

Fears of weaker demand have weighed on refinery margins, and continued weakness could see some refineries cut run-rates in China. If we were to see this, it would likely be the independent refiners who are first to cut, given their focus on the domestic market. Up until now, they have not received export quotas for refined products from the government. The first batch of export quotas for 2020 was released at the end of last year, and despite talk at the time that the government may issue export quotas to independent refiners, it was just state refiners who eventually received them. However given current developments, and expectations for weaker domestic demand, we could see the government include independent refiners in future quota releases. If this was to happen, it would suggest that refinery margins elsewhere would remain under pressure.

Moving on from oil, and the Chinese government has already provided some protection to domestic companies, including LNG importers, by offering them "force majeure" certificates as a result of the coronavirus outbreak, according to Platts. It is still unknown whether these certificates will be used, or whether we just see a delay in offtake. Regardless, the uncertainty does appear to have hit spot Asian LNG prices, which are now trading at US$3.88/MMBtu. This weakness has also dragged EU gas prices lower, with the potential for a growing proportion of spot cargoes making their way to Europe, due to the shrinking Asian premium.

Metals

Industrial metal markets remained under pressure yesterday amid panic caused by the coronavirus outbreak. LME Copper prices fell below US$5,600/t, and to levels not seen since September 2019. Zinc prices traded to an intraday low of US$2,182/t yesterday - levels last seen in July 2016, as the market continued to try to price in expected demand losses from China.

Turning to mine supply, and MMG reported that it had halted copper shipments yesterday from its Las Bambas mine in Peru as protestors blocked roads. While this highlights the mine supply risks faced by the copper market, participants are largely ignoring it. In 2019, the mine produced 383kt of copper-in-concentrate, and this was despite community roadblocks impacting logistics for over 100 days during the year.

Moving to precious metals, and unsurprisingly gold prices continue to remain well supported, with spot prices trading as high as US$1,586/oz yesterday. Meanwhile, the World Gold Council, in its latest quarterly update, estimated that overall gold demand declined by 1% YoY to 4,356t in 2019, with strong ETF buying offset by much weaker retail demand. In 4Q19 alone, global demand fell by 19% YoY to 1,045t; dragged down by weak jewellery and physical bar consumption. However, ETF purchases soared to 401t in 2019, compared to just 76t in 2018, with increased safe-haven appeal due to a number of macro and trade uncertainties over the course of the year.

Jewellery demand from the top two consumers - India and China - remained weak and posted annual declines of 9% and 7% respectively. For 2020, consumer demand in both nations is likely to remain weak, partly due to the stronger price environment. In fact, gold prices in India are at record high levels, with INR weakness making the precious metal even more expensive locally. On the supply side, global gold production grew by 2% YoY due to an 11% jump in recycled supply. This left the global market in surplus by 393t over 2019.

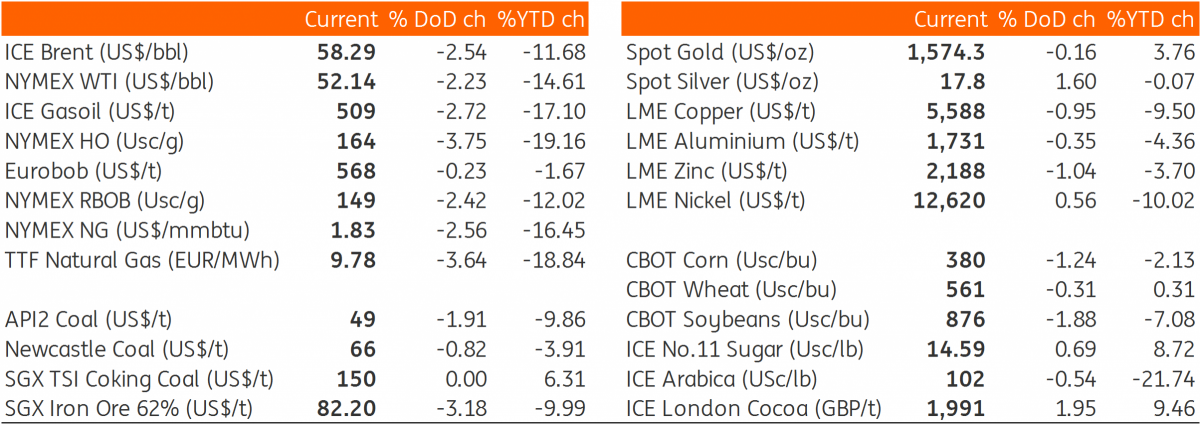

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap