The Commodities Feed: Venezuelan oil flows fall

Your daily roundup of commodity news and ING views

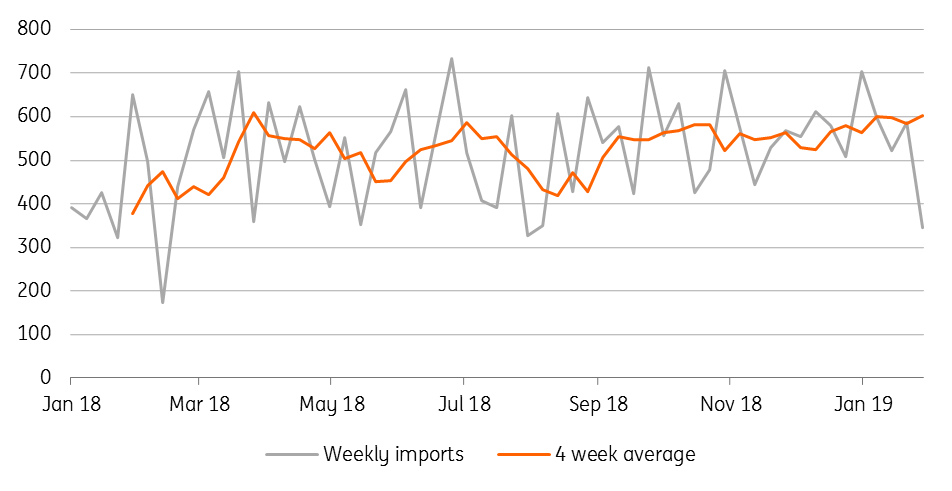

US imports of Venezuelan crude oil (Mbbls/d)

Energy

US crude oil inventories: The EIA reported yesterday that US crude oil inventories increased by 1.26MMbbls over the last week, less than the 2.51MMbbls build the API reported the previous day, and slightly less than the 1.85MMbbls increase the market was expecting. Crude oil imports from Venezuela over the week fell by 242Mbbls/d to 345Mbbls/d. Meanwhile, imports from Saudi Arabia increased by 168Mbbls/d over the week to 610Mbbls/d- however this is still somewhat lower than the 860Mbbls/d average over 2018.

Moving on, despite the general weakness seen in refinery margins, refiners increased utilisation rates by 0.6% to 90.7%. However gasoline inventories still saw a smaller than expected build- a 513Mbbls increase vs expectations of 1.5MMbls. Distillate fuel oil inventories fell by 2.26MMbbls, which was in line with expectations, and reflects stronger heating oil demand, with the colder weather in the US.

Sharara oilfield: Eastern Libyan forces have taken control over Libya’s largest oilfield, Sharara. This follows the shutting of the 300Mbbls/d field back in early December after tribesman took control of the field. Eastern forces have now asked the National Oil Company (NOC) to lift the force majeure that has been in place since the field was shut, however, as of yet there is little clarity whether the NOC will do so, and if production will resume.

Metals

Russian aluminium exports: Russian customs data shows that primary aluminium exports from the country fell by around 5% year-on-year to 3.06mt for full year 2018, reflecting the impact from sanctions on Rusal. Exports declined quite significantly in April 2018, just after the announcement of sanctions though recovered as we moved through the year due to sanctions relief.

Platinum ETF inflows: ETF holdings in platinum have edged consistently higher so far this year, up 286kOz year-to-date to total 2.6mOZ. Inflows have increased into platinum with the hopes of a revival in demand for the metal, which continues to look relatively cheap compared to the rest of the precious metals complex. The platinum/palladium ratio continues to trade below 0.59- levels last seen back in 2001.

Agriculture

Mar-18 white sugar expiry: The no.5 whites Mar-18 contract is set to expire next Wednesday, and current spread action in the Mar/May suggests that there is little appetite to receive sugar from the tape, with the spread currently trading at a discount of US$9.30/t. The whites market appears fairly well supplied, with the forward curve in full contango, whilst the March whites premium has also come under pressure in recent weeks- falling from around $65/t to US$57/t currently.

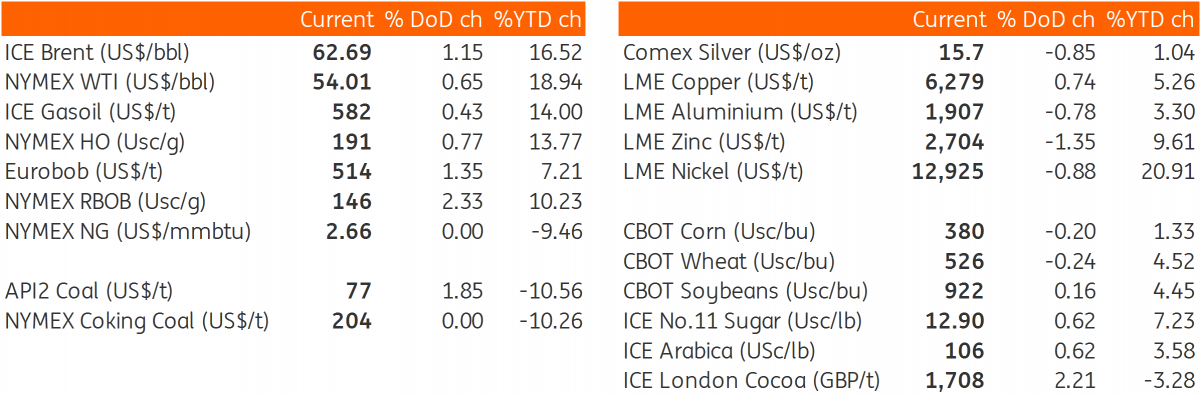

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap