The Commodities Feed: US shale output set to grow further

Your daily roundup of commodity news and ING views

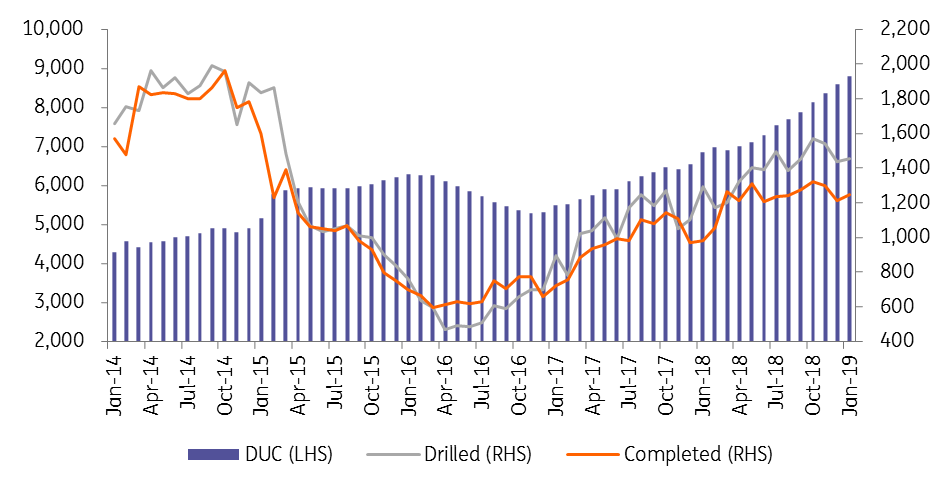

US drilled but uncompleted wells continue to rise

Energy

US drilling productivity: The EIA released its latest monthly drilling productivity report yesterday, where they estimate that US shale output in March will average 8.398MMbbls/d, up 84Mbbls/d from their February estimate of 8.31MMbbls/d. This February estimate was also revised higher, with the administration last month estimating that February output would average 8.18MMbbls/d. Meanwhile the number of drilled but uncompleted wells increased by 207 over January to total a record 8,798.

US crude oil inventories: The API is set to release its weekly inventory numbers later today, a day delayed due to a public holiday in the US on Monday. According to a Bloomberg survey, the market expects that US crude oil inventories increased by 3.1MMbbls over the last week. Meanwhile draws of around 900Mbbls and 1.5MMbbls are expected in gasoline and distillate fuel oil respectively.

Metals

Precious metal strength: Palladium has strengthened by more than 7% over the past week, hitting a fresh high of US$1,500/oz on fears of short supply. Earlier, Johnson Matthey forecast that the supply deficit could widen to around 1mOz in 2019, on the back of growing Chinese demand. Platinum also gained during the week though not as much as palladium, with the Pd/Pt price ratio increasing further to 1.83. Meanwhile gold has surged above US$1,350/oz on the back of a weaker dollar

Copper spread strength: The LME copper cash/3M spread started the week strongly, with it surging to a four year high of US$58/t, although has since retreated back to a backwardation of US$25/t. Earlier this week, the Indian Supreme Court ordered that Vedanta’s 400ktpa Tuticorin smelter remains shut, only supporting the view of a tighter refined copper market.

Agriculture

US grain export inspections: Latest data from the USDA shows that 1.03mt of soybeans were inspected for export over the last week, this compares to 962kt for the same week last year. From the 1.03mt inspected, 404kt was destined for China. Meanwhile 942kt of corn was inspected for export over the last week, up from 751kt in the previous week, and marginally lower than the 944kt inspected in the same week last year.

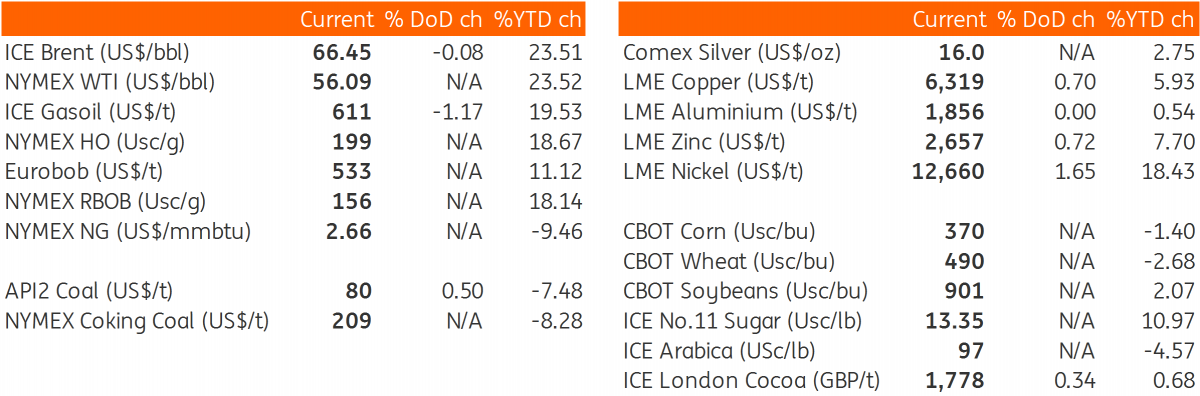

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap