The Commodities Feed: US oil supply makes a return

Your daily roundup of commodity news and ING views

Energy

The US oil industry is making a fairly quick return following last week’s hurricane activity. At its peak, almost 1.6MMbbls/d of US Gulf of Mexico (GOM) oil production was shut in, which is a little over 84% of total US GOM production. However, the latest data from the Bureau of Safety and Environmental Enforcement (BSEE), reported as of yesterday only 989Mbbls/d of oil production remained shut in. The impact from the shut-ins, along with lower utilisation rates at refiners in the region will be reflected in the EIA weekly numbers on Wednesday.

The latest monthly data from the EIA shows that US oil production rose 4.2% MoM in June to average 10.44MMbbls/d. This increase reflects producers bringing back production that they shut in over April and May due to the low price environment. However, total output was still down 13.7% YoY. We would have likely seen production continue to grow over July and August as more producers brought back shut-in production. Obviously given the collapse in rig activity in the US, we are not going back to pre-Covid-19 production levels anytime soon.

Metals

Precious metals have resumed their upward rally, with spot gold prices trading above US$1970/oz after hitting US$1923/oz on Friday. Expectations of lower for longer when it comes to US interest rates and continued weakness in the USD index are setting a favourable environment for precious metals, especially gold. Looking at ETF holdings, total known gold holdings reported inflows of around 367koz over the last 4 days, taking total holdings to 108.9moz.

Looking at base metals, LME was shut yesterday due to a bank holiday, however COMEX copper managed to settle more than 1.5% higher, on the back of strong manufacturing data from China. The latest data from the National Bureau of Statistics shows that China’s manufacturing PMI expanded for a sixth straight month and stood at 51 in August, not far off market expectations of 51.2. Meanwhile, the latest data from the Shanghai Metals Market shows that treatment charges for imported copper concentrate in China extended their declines, falling to US$50/t on Friday, compared to YTD highs of US$69/t in March.

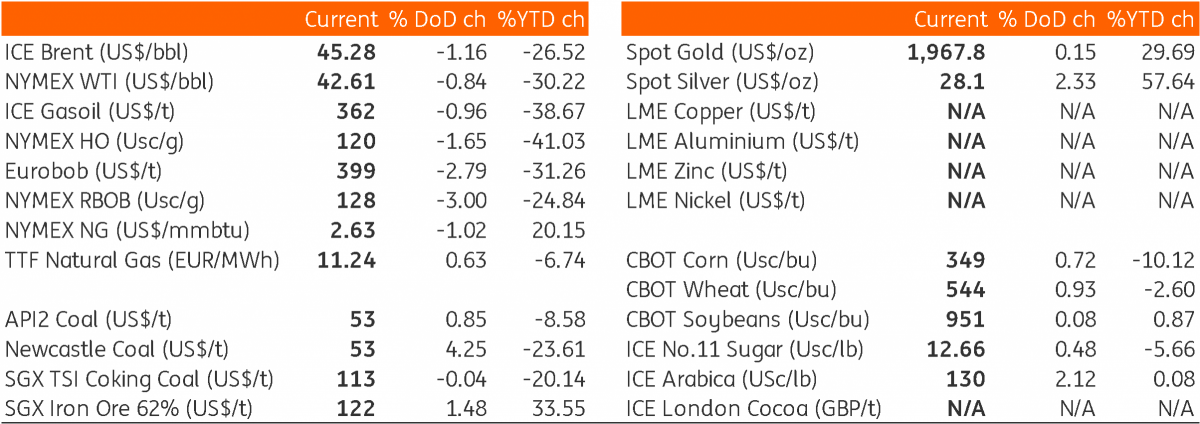

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap