The Commodities Feed: US inventories continue to drawdown

Your daily roundup of commodity news and ING views

Energy

OPEC has been slower in bringing back crude oil supply last month, according to a Bloomberg survey as Nigeria and Iraq lowered their crude oil production to make up for the shortfall in production cuts earlier. The survey shows that OPEC increased crude oil output by 550Mbbls/d in August 2020, less than half of the permitted 1.2MMbbls/d increment. Nigeria lowered the oil supply by 110Mbbls/d while Iraq also cut 70Mbbls/d as per the survey.

Meanwhile, Saudi Arabia has increased supplies by around 410Mbbls/d to 8.86MMbbls/d in August; though output levels are still lower than its quota of 8.99Mmbbls/d. Kuwait and UAE also pushed up their supplies in August.

Turning to the US, crude oil production in the Gulf of Mexico continues to return with the latest data from the Bureau of Safety and Environmental Enforcement (BSEE) showing that only 525Mbbls/d of crude oil production capacity remained shut-in as of yesterday.

Refineries in the region have also been preparing to restore production with Motiva planning to restart operations at its 607Mbbls/d Port Arthur refinery this week and other refineries also at various stages of the restart. Finally, weekly numbers from API show that the crude oil inventory in the US dropped by 6.4MMbbls over the past week, significantly more than the 2.1MMbbls drawdown that the market was expecting. Gasoline and middle distillate inventory also declined 5.8MMbbls and 1.4MMbbls respectively due to refinery closures.

Metals

As the USD index fell below two-year lows yesterday, metals markets gained further momentum. The COMEX gold prices climbed back to US$2,000/oz whilst the LME copper prices jumped over two-year highs and touched the intra-day highs of US$6,830/t yesterday majorly due to the continued optimism from a better economic data release.

Meanwhile, LME data shows that copper inventories at the exchange warehouses continued the decline for a 14th consecutive day and dropped further by 1.1kt to 88.3kt (lowest since December 2005) as of yesterday. Net outflows for August now stand at 40kt. On the other hand, the continuous supply squeeze in the copper market pushed the LME cash/3m spread into a deeper backwardation of US$30.5/t (highest since mid-March 2019 levels) at the end of August, compared to a backwardation of US$5/t during the start of the month.

The nearby tom-next spread had spiked to US$15/t yesterday. On copper’s mine supply, the Peruvian mine minister said that July copper mine productions had fallen by 2.2% YoY to 198,796 tonnes. Based on electricity demand, the nation’s mining industry in Augusty was 5% below the same period of last year. Total productions in the first seven months are lower from last year, but July productions figures suggest the copper mining business has back on track on a five-year average basis.

Agriculture

It wasn’t much of a surprise that the crop condition in the US worsened further last week as hurricane activity in the country impacted the current crop. The USDA rated 66% of the current soybean crop in good-to-excellent condition compared to 69% a week ago and a high of 74% three weeks ago. For corn, 62% of the US crop is rated good-to-excellent, down from 64% on the preceding week, but still higher than the 58% seen at the same stage last year.

In its first estimates for 2020/21, the International Sugar Organization forecasts the global sugar market to face a supply deficit of 0.72mt for the year. For 2019/20, the Organization has lowered the supply shortfall estimates to just 0.14mt in comparison to previous estimates of 9.3mt on account of higher production from Brazil and Covid-19 related demand slowdown.

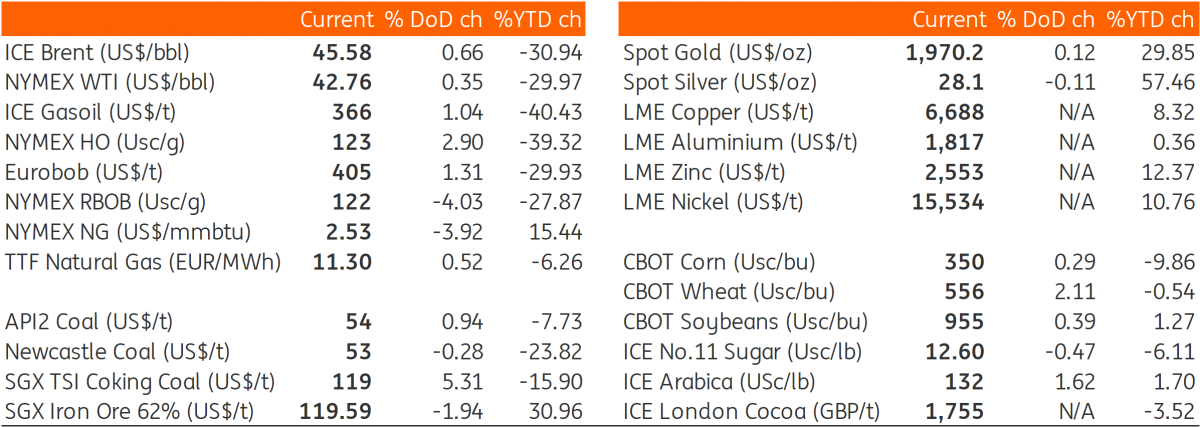

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap