The Commodities Feed: US drilling continues to slow

Your daily roundup of commodity news and ING views

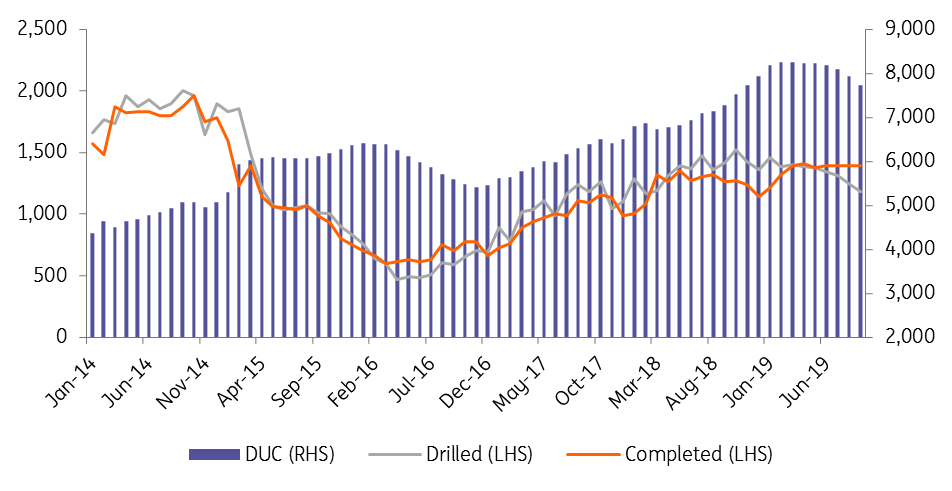

US drilled but uncompleted wells

Energy

US drilling productivity: The EIA released its monthly drilling productivity report yesterday in which it estimated that US shale oil production will increase by 58Mbbls/d month-on-month to average 8.97MMbbls/d over November. The key region driving this growth continues to be the Permian, where output is estimated to increase by 63Mbbls/d to 4.61MMbbls/d. Meanwhile, declines of 12Mbbls/d and 13Mbbls/d are expected in Eagle Ford and Anadarko, respectively.

Looking at the drilled but uncompleted well inventory, we continue to see a decline, with DUCs declining by 206 over the month to total 7,740 by the end of September. This is the largest monthly decline in US DUCs that has been seen going back as far as 2014. The key behind this fall, is declining drilling activity, and with a heavy global surplus over 1H20, pressure is likely to remain on prices, and in turn on drilling activity.

Today will see the API release its weekly inventory report, and market expectations are that US crude oil inventories increased by 3MMbbls over the last week. If confirmed by the API and the EIA today, this would likely put some immediate pressure on the market, in an environment where demand concerns continue to linger.

Tanker rates ease: Having rallied significantly for much of this month on the back of US sanctions on several Chinese ship owners, tanker rates this week have finally started to fall. VLCC rates from West Africa to China rallied from around US$3.40/bbl at the start of the month, to over US$10/bbl earlier this week, only to decline to a little over US$8/bbl yesterday, according to Bloomberg numbers. The general strength in freight rates has led to concerns that refineries will start to cut run rates, and this concern has been partly reflected in the prompt ICE Brent time spread, which has come under pressure this month.

Metals

Copper disruptions: MMG has halted nearly 90% of mining capacity at the 400ktpa Las Bambas mine in Peru due to ongoing local protests against mining operations, and the mine could be closed fully today if protests continue. MMG declared ‘force majeure’ on copper supplies, which came into effect last Friday, as protesters blocked road access to the mine, which prevented the transportation of copper concentrate. In neighbouring Chile, mineworkers at Teck’s 60ktpa Carmen de Andacollo copper mine have been on strike for the past two days due to a dispute over the new wage agreement. Mine supply disruptions from South America could tighten the market over 4Q19; however price direction will likely continue to be dictated by the demand picture, given the softer economic environment and uncertainty.

Rio Tinto aluminium: Rio Tinto has lowered its production guidance for aluminium due to maintenance issues and the low price environment, which is weighing on operating rates at refineries and smelters. Rio Tinto expects bauxite production to total around 54mt in 2019 compared to its earlier estimate of 56-59mt, while alumina production is expected to come in around 7.7mt compared to the previous forecast of 8.1-8.4mt. Aluminium production is also expected to come in at the lower end of the guidance range of 3.2-3.4mt.

Agriculture

US crop progress & export inspections: The weekly crop progress report from the USDA shows slower progress on crop harvesting for soybean and corn. The latest data shows that soybean harvesting in the US increased to 26% of the crop as of 13 October 2019 (+12% week-on-week) compared to the five-year average of 49%. For corn, 22% (+7% week-on-week) of the current crop was harvested to date, versus a five-year average of 36%.

Looking at export inspections from the US, 471kt of corn was inspected for export for the week ending 10 October, which takes total inspections for the current marketing year to 2.5mt, well below the 6.92mt inspected by the same stage last year. As for soybeans, export inspections are holding up better, with 955kt inspected over the last week, which takes total export inspections for this marketing year to 5.16mt, up from 4.8mt at the same stage last year, and reflects stronger Chinese buying over the past month.

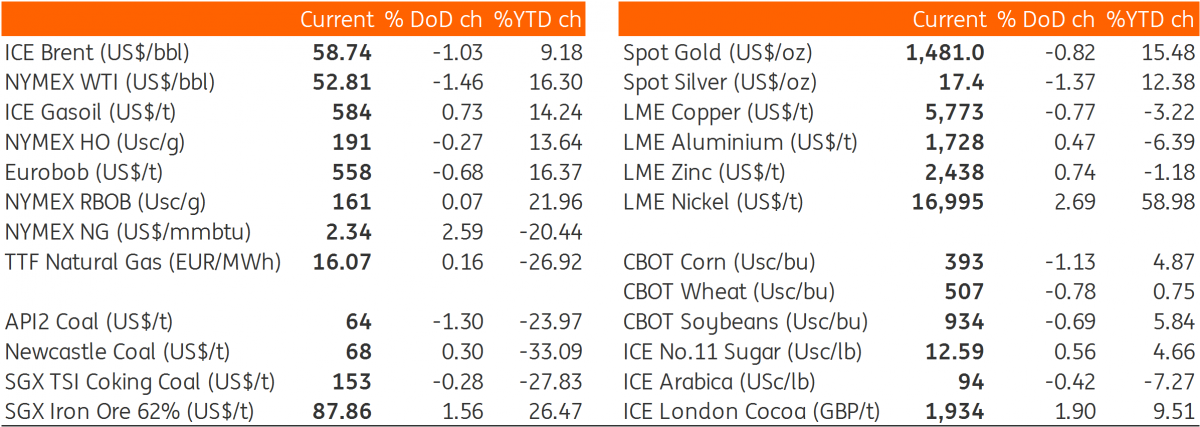

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap