The Commodities Feed: US crude oil imports plummet

Your daily roundup of commodity news and ING views

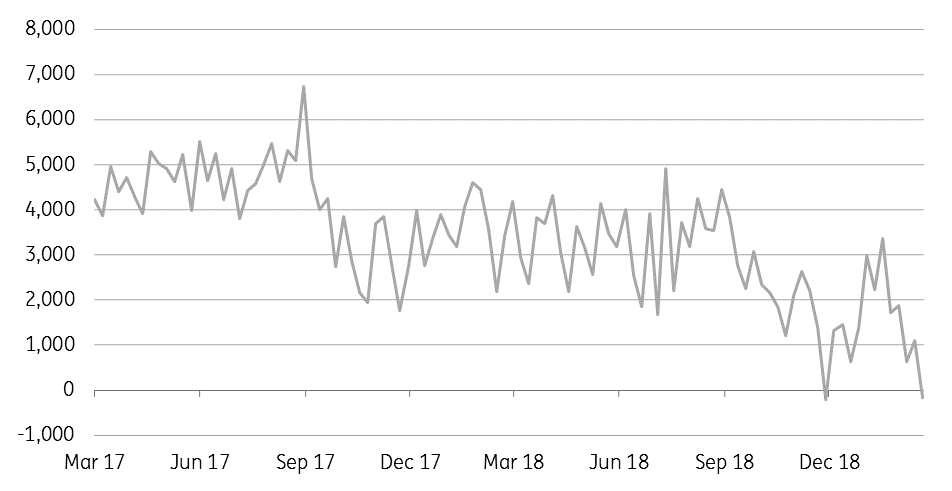

US weekly petroleum net imports (Mbbls/d)

Energy

US crude oil imports & inventories: Yesterday’s EIA report was a surprise for the market, with US crude oil inventories falling by 8.65MMbbls over the last week, compared to expectations of a 3MMbbls build. The key driver behind this was a significant drop in crude oil imports, which fell by 1.43MMbbls/d to average 8MMbbls/d over the week- the lowest number seen since late 1996/ early 1997. The Saudis appear to remain committed to reducing flows to the US, and over the last week these fell by 248Mbbls/d to 346Mbbls/d, and in doing so have finally achieved an overall draw in US crude oil inventories. Meanwhile, US sanctions on Venezuelan oil have meant that these flows have also declined- falling by 350Mbbls/d over the week to average 208Mbbls/d.

While imports fell significantly, US crude oil exports held up fairly well. Crude exports over the last week averaged 3.36Mbbls/d, slightly down from the record 3.6MMbbls/d seen in the previous week. A combination of weaker imports and robust exports meant that the US swung to a small net exporter of 162Mbbls/d of crude oil and refined products over the week.

The weekly report was clearly constructive due to the surprise stock drawdown. Moving forward, if the fairly wide WTI/Brent discount continues to entice US crude oil exports, whilst Saudi flows remain under pressure, we could see further stock drawdowns in the coming weeks, which could offer further support to the market. The clear risk around this though, is if President Trump becomes more vocal around stronger oil prices.

Metals

Global crude steel output: The latest data from the World Steel Association shows that global crude steel production increased 1% year-on-year to 146.7mt in January, with Chinese steel output rising 4.3% YoY to 75mt, while output from the rest of the world fell 2.2% YoY to 71.7mt. The Chinese steel industry has been resilient so far, despite trade war concerns and slowdown fears. However, falling profit margins and shrinking manufacturing activity may have an impact moving forward. China’s Manufacturing PMI fell to 49.2 in February, compared to 49.5 in January- highlighting a further contraction in activity.

Zinc treatment charges: Annual negotiations for zinc treatment charges are currently underway, though both miners and smelters are reportedly quite some distance apart in where they think charges should be fixed, with a fairly wide range of US$200-300/t. This compares to US$147/t, which was agreed last year. Given the expected improvement in concentrate supply this year, we would not be too surprised to see treatment charges towards the top end of the range.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap