The Commodities Feed: US crude inventories down by 10.8MMbbls

Your daily roundup of commodity news and ING views

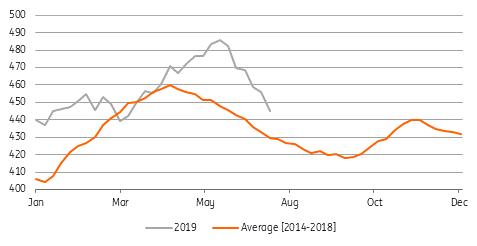

COTD US crude oil inventory (MMbbls)

Energy

EIA weekly report: latest data from the EIA shows that the crude oil inventory in the US dropped 10.8MMbbls over the last week, largely in-line with the API numbers reported yesterday but significantly more than the 3.9MMbbls of inventory drawdown that the market was expecting, according to a BBG survey. US crude oil inventory fell around 40MMbbls over the past one and half months with the current inventory surplus over the 5-yr average narrowing down from 38MMbbls in June 2019 to 15MMbbls currently. Products inventory was marginally changed with gasoline stocks down 226Mbbls while distillate inventory was up 613Mbbls. Refinery utilization dropped by 1.3% over the week with refineries operating at 93.1% as on 19 July. On the trade side, crude oil imports increased 196Mbbls/d over the week to 7.03MMbbls/d while exports increased 758Mbbls/d to 3.29MMbbls/d. Turning to production and the EIA estimates that the US oil production dropped 700Mbbls/d over the last week to 11.3MMbbls/d as the tropical storm Barry impacted around 73% of the oil production in the Gulf of Mexico at its peak. As all of the operations were restarted by last weekend, US crude oil production is likely to recover back to normal levels in the next weekly report.

Metals

Iron ore: Vale says that it has received approval to restart dry processing of ore at its Vargem Grande Complex and that it will resume the operations shortly that will see around 5mt of additional iron ore production for the current year. Iron ore supply situation has been eased a bit in 2H19 as supplies from Australia and Brazil picks up while the demand side shows risks of slowdown at the higher price levels. The steel mills’ profitability has been a concern due to higher raw material prices and steel mills may cut on operating rates if profitability doesn’t improve over the coming weeks.

Platinum gains: investors have been returning to platinum again with prices up more than 4% over the past one week and Palladium-platinum ratio softening from the peak of 1.94 in early July to 1.75 currently. The uncertainties around the ongoing wage talks at the South African platinum mines and optimism over demand increment due to switch from palladium has been supporting platinum market over the past few weeks. Total known ETF holding of platinum increased by 73koz in the month so far (and 739kOz in the year so far) with ETF investors holding a record 3.06mOz of platinum currently.

Agriculture

Sugar update: Latest data from Brazil’s Sugarcane Industry Association, UNICA shows that sugar production in the Centre-South region of Brazil dropped 19.1% YoY to 1.94mt over the first half of July 2019, lower than the 2.02mt of output that market was expecting according to a BBG survey. Sugar cane crushing dropped 9.5% YoY to 40.9mt with 36% of the cane allocated for sugar production compared to 38.3% allocation at the same stage last year. Meanwhile, India announced to create a buffer stock of around 4mt of sugar over the next one year starting 1 August to absorb excess supply from the market and support prices.

China tariffs: Beijing has allowed 5 companies to import up to 3mt of US soybean free of retaliatory import tariffs as China and the US continue the trade discussions. The measure is aimed as a goodwill gesture to start the trade discussion on positive terms that will resume on Monday when a US trade delegation visits China. Any hint of constructive talks at the discussion is likely to support soybean and corn prices next week.

Daily price update