The Commodities Feed: Trade optimism supports the complex…for now

Your daily roundup of commodity news and ING views

Energy

Oil, along with the broader commodities complex, benefited from the initial optimism around a phase-one trade deal between China and the US. What the market needs now though is clarity around exactly what the deal entails. The longer we have to wait for this detail, the more likely market participants will start to question how good a deal it actually is. Looking at data that predates the deal, speculative positioning in oil has grown in recent weeks. The latest exchange data shows that the speculative net long in ICE Brent increased by 42,885 lots over the last reporting week to total 373,843 lots as of last Tuesday - the largest net long position speculators have held in ICE Brent since May. This increase is reflective of the buying seen around the OPEC+ meeting, along with the more constructive trade narrative.

For now, ICE Brent continues to hover close to US$65/bbl, with the tight prompt physical market and positive trade sentiment continuing to offer support. However, keep an eye on weak refinery margins. All regions continue to see margins grinding lower, with Asia seeing negative margins, whilst in North-West Europe, margins are flirting with negative territory. The longer these weak margins persist, the more likely we will see them starting to weigh on refinery run rates, which would obviously be negative for crude oil demand.

Looking at recent data releases, Baker Hughes reported on Friday that the oil rig count in the US increased by 4 over the week to total 667. This is the first increase that we have seen in the rig count since October. However, rig activity in the US continues to be in a clear downward trend, with the number of active oil rigs falling by 218 over the course of this year. It has been this slowdown that has called into question US supply growth over 2020. In the EIA’s last Short Term Energy Outlook, US supply growth for 2020 was revised down from 1MMbbls/d to 930Mbbls/d.

Metals

The LME metals complex made decent gains last week, with risk appetite clearly returning to the complex. Although the move on Friday was largely muted, despite the phase one agreement on the US/China trade deal. Nickel was the big mover over the week, rallying more than 5%, driven by speculative buying in China. This strength is somewhat at odds with inventories, which have increased along with the rally in the market. LME nickel inventories increased by a hefty 54,342 tonnes over the last week to 123,228 tonnes. Meanwhile, copper also had a fairly strong week, up more than 2%, reflecting broader optimism along with solid fundamentals. LME copper inventories fell by another 22kt over the past week, with stocks now standing at 171.8kt - the lowest level since April 2019. Meanwhile, the copper concentrate market remains tight, as reflected in the low treatment charges. The more positive environment is also reflected in speculative positioning data. The latest data from the CFTC show that speculators bought 31,240 lots in COMEX copper over the week, leaving them with a net short of 13,314 lots - the smallest net-short held since April.

Agriculture

Unsurprisingly, given developments on the trade front, and promises from China that they would increase purchases of US Agri products, the agricultural complex has strengthened, with CBOT soybeans rallying more than 1% on Friday. The timing of the deal would be welcome news for US farmers, with them in their peak export period, while it would also give them more clarity around demand prospects for 2020, and would make them more comfortable increasing soybean plantings for next season. Finally, the new Argentinian government has increased taxes on agricultural exports, as widely expected. The tax increases include soybean & products, corn, wheat and beef. Export taxes are expected to be as high as 30% on soybean & products, 12% on corn and wheat, and 9% on beef exports. Given that these increases were largely expected, farmers had boosted exports in recent months in order to avoid these higher taxes. It is still unclear exactly when these higher taxes will come into force. Obviously, these export taxes will weigh on Argentinian competitiveness to the world market over the coming year.

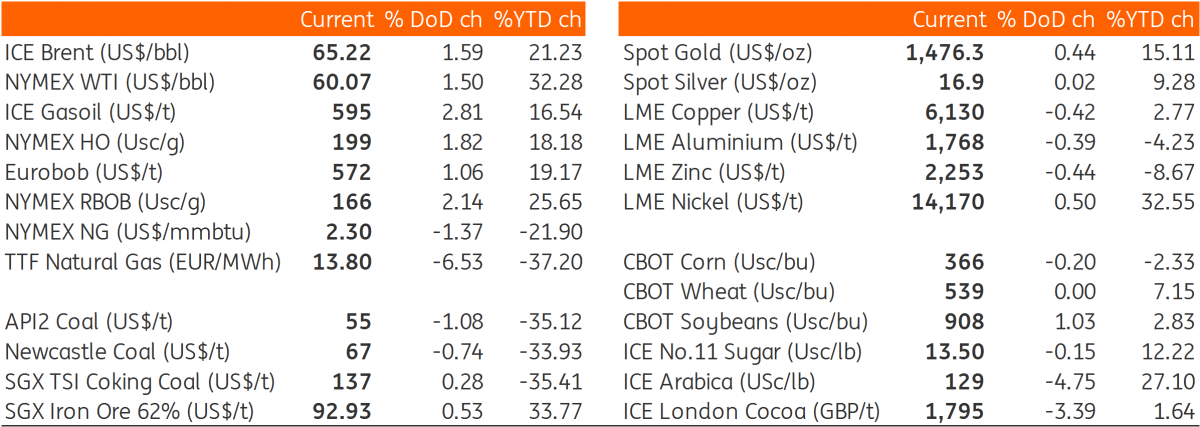

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap