The Commodities Feed: Trade concerns resurface

Your daily roundup of commodity news and ING views

Energy

Oil markets were weaker in early morning trading, with media reports that the US will not cut existing tariffs on Chinese goods until after the US election in November. Any reduction will depend on how China complies with the phase one trade deal, which is expected to be signed today. Meanwhile Treasury Secretary Steve Mnuchin said that these tariffs will remain in place until a phase two deal is concluded. Given how long it has taken to get phase one done, it’s hard to imagine phase two will happen any time soon.

Looking specifically at oil, the Russian News Agency TASS has reported that the OPEC+ extraordinary meeting scheduled for March could be delayed until June, given that by March the group will only have January production data. The issue with pushing back this meeting to June is that the current deal is set to expire at the end of March. Clearly if the deal expires with no extension this will be bearish for the market, given the 2Q20 surplus. However if the group announce that the deal will remain in place at least until a potential June meeting, this would be seen as much more constructive for the market.

Meanwhile there were a couple of data releases yesterday. The usual US inventory numbers from the API showed that crude oil inventories increased by 1.1MMbbls over the week, in line with market expectations. The more widely followed EIA release will be published later today. Then the EIA yesterday released its monthly Short Term Energy Outlook, and surprisingly their US oil supply growth forecast for 2020 was revised up from 930Mbbls/d to 1.06MMbbls/d, which would see output over the year average 13.3MMbbls/d. This slight revision higher comes despite a continued slowdown in rig activity, and consequently concerns over slowing US supply growth. The EIA also published their first 2021 forecast in the report, where they forecast supply growth of 410Mbbls/d, which would be the slowest output growth rate from the US since 2016, when output declined by 600Mbbls/d YoY. The sizeable slowdown forecast for output growth will be welcome news for OPEC, and suggests the group can likely play less of an active role in trying to keep the market in balance next year. A large part of this will depend on whether US sanctions against Iran remain in place over 2021.

Metals

Better-than-expected trade numbers from China yesterday added to the short term optimism ahead of the signing of the phase one trade deal between China and the US on Wednesday. More recent reports that existing US tariffs on Chinese goods will remain in place for now have put some downward pressure on base metal markets in early trading this morning. Meanwhile, looking at the LME’s Commitment of Traders report from yesterday the grand long-only position in copper (non-risk reducing) bounced to a fourteen-month high for the week ending January 10. It’s a similar story for aluminium, where the grand long position hit its highest level since mid-November. However, one clear difference is that all categories for copper show net longs, whilst for aluminium the “investment funds” category has held a net short position since the end of 2018, and in fact over the last reporting week this net short increased.

Agriculture

No.11 raw sugar prices have continued to rally, settling more than 1.1% higher yesterday, and taking YTD gains to almost 7%, meanwhile the Mar/May raws time spread has also witnessed considerable strength so far this year, with the spread flipping from contango to a slight backwardation, reflecting a tightening in the prompt market. Furthermore the refined white sugar market is also pointing towards tightness, with the March whites premium rallying to a little over US$74/t, up from around US$63/t at the start of the year. While the strength in the whites premium may surprise some, given the scale of Indian stocks, it is important to remember that the bulk of this sugar is not deliverable against the No.5 white sugar contract.

The sugar market was expected to strengthen this year, as it transitions from a surplus to deficit environment, however the scale of the move has clearly taken many by surprise. This has occurred as it has become more apparent that the deficit for the current marketing year will be larger than many had initially expected. Meanwhile stronger Brazilian hydrous ethanol prices have also provided some support, given that it lifts ethanol parity levels. However it is important for the sugar market not to rally too much above ethanol parity levels, as this may see mills in CS Brazil allocate cane away from ethanol to sugar production in the 2020/21 season.

The strength in the world market is also pulling out Indian sugar, with reports that export contracts for 2.8mt of sugar have been agreed since the start of the marketing year in October. Sustained strength in world market prices could mean that India finishes the season close to its target of 6mt of exports for the current marketing year, which would help eat into the sizeable stocks the country currently holds, while also providing somewhat of a cap to world market prices.

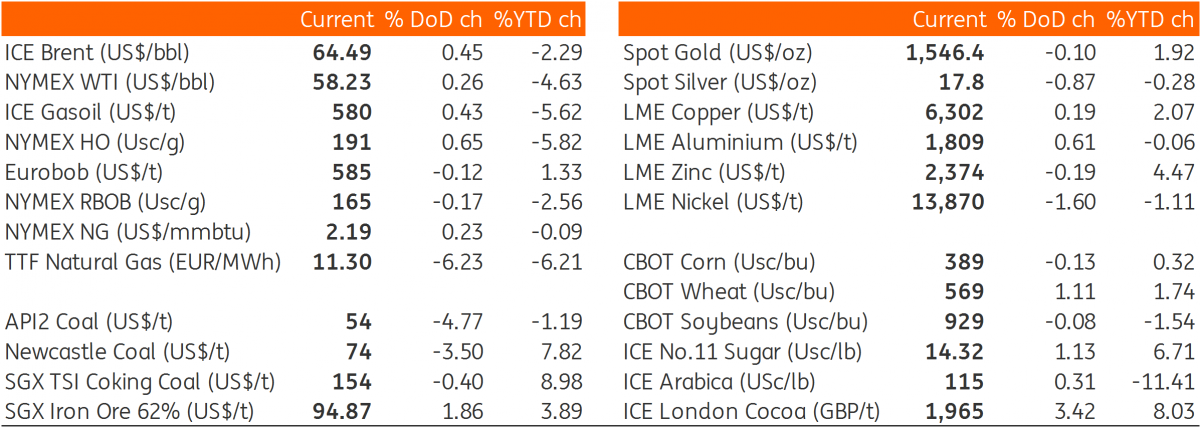

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap