The Commodities Feed: The nickel squeeze

Your daily roundup of commodity news and ING views

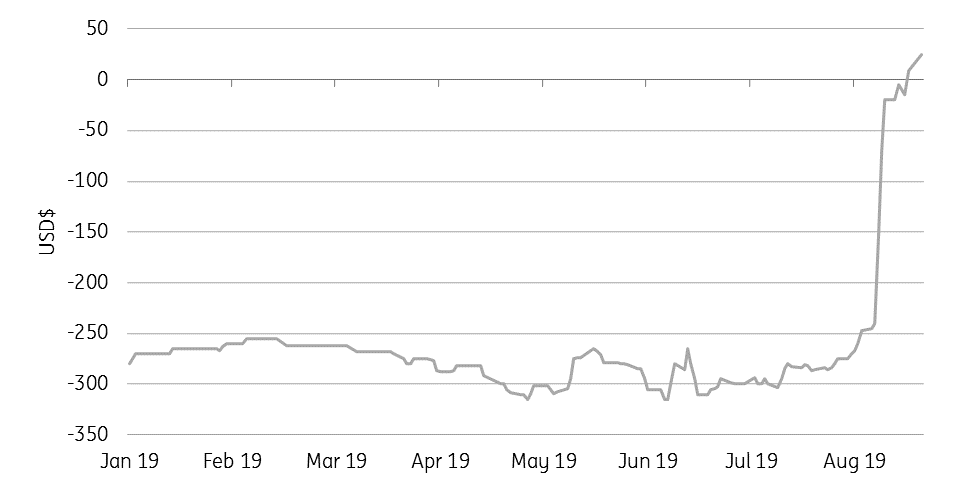

LME Nickel Dec19/Dec20 spread (US$/t)

Energy

EIA confirms big draw: The oil market got another boost yesterday, with ICE Brent settling 1.65% higher on the day. This followed the EIA confirming a large drawdown in US crude oil inventories over the last week. The EIA reported that crude oil stocks fell by 10.03MMbbls, which was roughly aligned with the 11.1MMbbls draw reported by the API the previous day, however significantly more than the 2.85MMbbls drawdown that the market was expecting, according to a Bloomberg survey.

The large decline was driven by a 1.29MMbbls/d fall in exports over the week, averaging 5.93MMbbls/d- the lowest weekly import number since February. Cushing crude oil inventories also continued their decline, falling by 1.98MMbbls, and taking stocks at the WTI delivery hub to the lowest levels since December 2018. The tightening in stocks should continue to be supportive for the WTI spread structure.

Meanwhile, with refinery utilisation rates falling by 0.7 percentage points to 95.2% over the week, and product demand increasing over the week, we also saw larger than expected drawdowns in gasoline and distillate fuel oil inventories, which declined by 2.09MMbbls and 2.06MMbbls, respectively.

Metals

Nickel spreads tighten further: LME nickel spreads continue to tighten after the front end of the forward curve shifted from contango to backwardation in mid-August. We flagged the Dec19-Dec20 spread two weeks ago, which was squeezed from $240 contango on 13 August to $45 backwardation as of August 28 evening evaluation. This suggests continued spread borrowing along the curve and it seems that the market could see further squeezing of the shorts. LME warrant holdings data (although two-days delayed) has suggested there were entities holding a high percentage of LME warrants along the front of the curve. LME inventories have risen by around 4.7% over August, but the total level is still the lowest since late 2012. Outright prices closed more than 2% higher on Wednesday, the best performer within the industrial metals complex.

Silver catching up: Silver prices have increased by around 8% over the past week and 13% in the month so far, outpacing the gains seen in gold and other precious metals as investors seek value in the white precious metal. The gold/silver price ratio has softened further to 83.8 currently, compared to around 88 a week ago, and a peak of above 93 in July. Total known ETF holdings of silver increased by around 7mOz over the past week and by more than 100mOz since the end of June - total ETF holdings in silver now stand at a record high of 629mOz. Silver may have some more room to run given the historical gold/silver price ratio of around 65, and the continued risk-averse sentiment among investors.

Agriculture

India extends subsidies: The Indian government has agreed to extend export subsidies for the Indian sugar industry for the 2019/20 season. The package will total INR62.68b for the export of 6mt of sugar, which works out to INR10,447/tonne or US$145/t. However at current price levels, it is unlikely that the full 6mt will be exported, with domestic prices currently around US$160/t above the No.5 world market, and so the need for further strength in world market prices. Given the small deficit outlook for the world market over the 2019/20 season we expect prices to slowly trend higher, but the threat of large Indian sugar exports will likely limit the upside.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap