The Commodities Feed: Saudis set to reduce oil flows to the US

Your daily roundup of commodities news and ING views

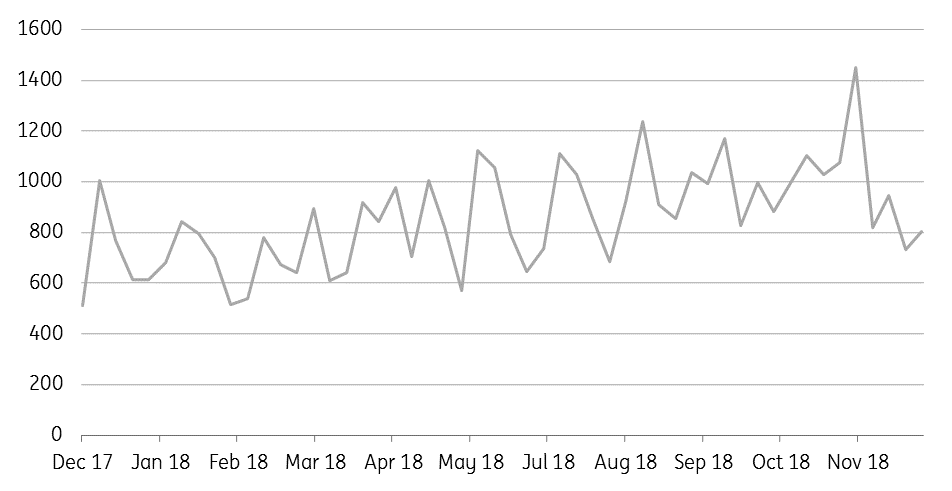

US weekly imports of Saudi crude oil (Mbbls/d)

Energy

Saudi oil flows to the US: Bloomberg reports that Saudi Arabia is targeting to reduce oil flows to the US in order to help drawdown visible inventories. US imports of Saudi oil peaked at 1.45MMbbls/d for the week ending 9th November, which conveniently was the week of mid-term elections in the US. Since then weekly imports from the Kingdom have fallen significantly, with them reaching 802Mbbls/d for the week ending 7th December. Given that the market is fixated on weekly EIA data, it makes sense for the Saudis to reduce flow to the US, with the hope that it improves sentiment in the oil market.

IEA oil market report: The IEA released its monthly oil market report yesterday, and the agency revised lower its estimate of non-OPEC supply growth by 415Mbbls/d to 1.5MMbbls/d, down from 2.4MMbbls/d growth in 2018. This reduction will largely reflect the agreed cuts taken by non-OPEC members of the OPEC+ deal, along with the mandatory cuts announced in Alberta, Canada. Meanwhile the agency has left unchanged its demand growth estimates for both 2018 and 2019 at 1.3MMbbls/d and 1.4MMbbls/d respectively. Finally, OECD commercial stocks increased by 5.7MMbbls over October, taking them above the 5 year average for the first time since March.

Metals

China metals production: Chinese steel production fell 6% MoM (+11% YoY) to 77.6mt in November, with squeezed profit margins and winter restrictions pushing steel mills to reduce operating rates; YTD steel output is up 6.7% YoY to total 857mt. Among base metals primary aluminium output increased 4% MoM to 2.82mt, while YTD output increased 7.5% YoY to 31.45mt. However, Hongqiao and Chalco did announce a combined c.1mt pa of winter capacity cuts in recent weeks, which should see aluminium production easing moving forward.

Zinc backwardation eases: The LME zinc cash premium over 3M forwards has softened recently from US$125/t on 5 Dec to US$67/t; however, even at current levels, cash premiums are significantly higher than historical averages and reflects the tightness in the physical market. Both LME and SHFE stocks (combined 141kt) are near a decade low, and are only enough to cover less than 4 days of demand. We continue to hold the view that the supply picture will improve as we move into 2019, with a continued increased in mine supply.

Agriculture

El Nino risk grows: According to US forecaster, NOAA, the likelihood of an El Nino weather event over the Northern Hemisphere winter months has increased to 80%, whilst the chances of it continuing into spring are 55-60%. El Nino can have a significant impact on agri markets. Drier weather across southern Africa, South East Asia and South Asia are usually associated with such an event. Therefore this is a risk to sugar production in these regions. Although saying that an El Nino weather event usually means wetter than usual weather in CS Brazil, which should be beneficial for the 2019/20 CS Brazil sugarcane crop.

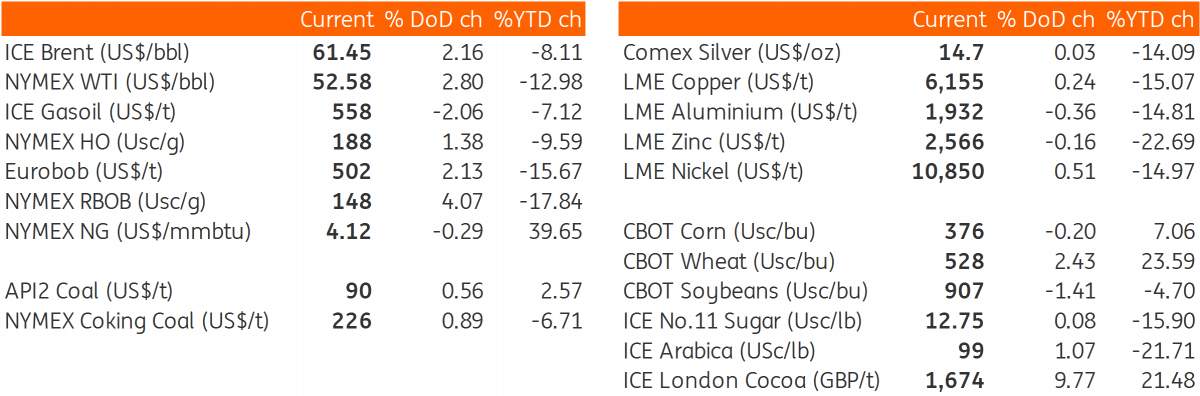

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap