The Commodities Feed: Saudis set to cut oil output further

Your daily roundup of commodity news and ING views

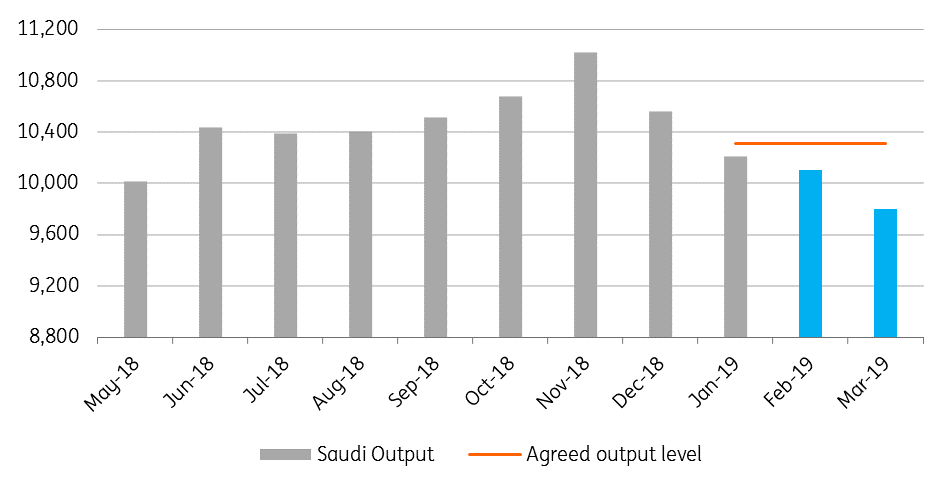

Saudi oil production set to fall (Mbbls/d)

Energy

OPEC and US supply: OPEC released its monthly oil market report yesterday, which showed that OPEC output totalled 30.81MMbbls/d over January, down 797Mbbls/d month-on-month. The group also lowered its demand growth estimate for 2019 by 50Mbbls/d to 1.24MMbbls/d. It estimates that demand for OPEC crude oil will fall by 240Mbbls/d over 2019 to 30.6MMbbls/d.

The Financial Times reported yesterday that Saudi Arabia plans to reduce oil output to 9.8MMbbls/d in March, which is well below their agreed output level of 10.3MMbbls/d, as well as their January output level of 10.2MMbbls/d.

Finally, the EIA released its latest Short Term Energy Outlook yesterday, revising higher its US supply growth estimates for 2019 from 12.1MMbbls/d to 12.4MMbbls/d, whilst its 2020 estimate was increased from 12.9MMbbls/d to 13.2MMbbls/d.

US crude oil inventories: The API reported yesterday that US crude oil inventories declined by 998Mbbls over the last week, this compares to market expectations for an inventory build of around 2.4MMbbls. It also reported a 746Mbbls build in gasoline, which was less than the 1.17MMbbls increase expected, while the 2.48MMbbls draw in distillate fuel oil was larger than the 1.67MMbbls draw expected. The EIA is scheduled to release its weekly report later today.

Metals

LME aluminium queues: The queue to withdraw aluminium from one LME warehouse at Port Klang in Malaysia reached 118 days at the end of January. There is currently 626kt of aluminium inventory sitting in Port Klang, of which 427kt is earmarked for withdrawal. The prospect of not paying rent for metal in the queue does suggest that we could see further cancellations moving forward, which would likely increase waiting times further.

Agriculture

Brazilian soybean output: Brazilian state agency, Conab, has revised down its estimate for 2018/19 soybean production to 115.3mt, this compares to the January estimate of 118.8mt. The reduction in output is due to lower than expected yields amid dry weather conditions in growing regions. While a fairly large downgrade, the agency’s latest estimate is still higher than the 114.6mt the market was expecting, according to a Bloomberg survey.

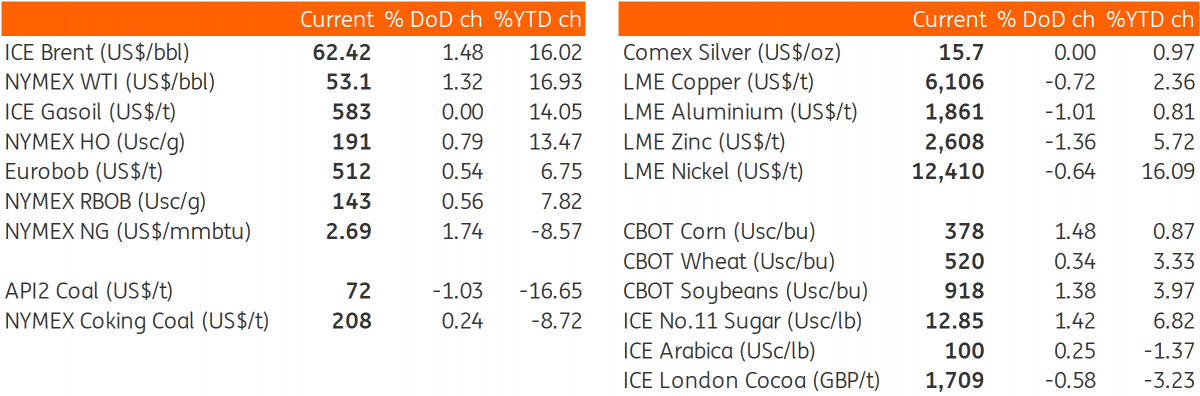

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap