The Commodities Feed: Saudi-US oil flows fall

Your daily roundup of commodity news and ING views

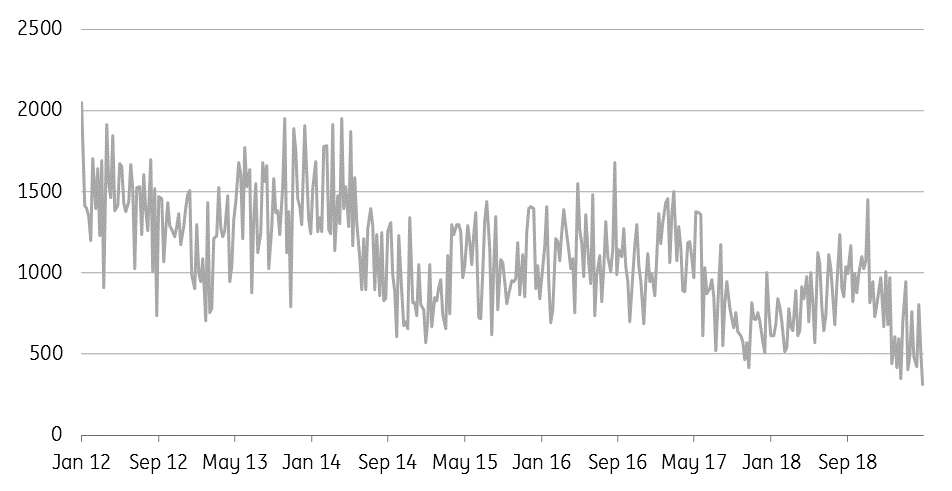

US imports of Saudi oil fall to a record low (Mbbls/d)

Energy

US weekly oil numbers: The oil market has come under renewed pressure this morning, with the hope of a China/US trade agreement fading. However fundamentally the oil market remains constructive, with the global balance tightening, and still the potential for a number of supply side risks.

The EIA yesterday reported that US crude oil inventories declined by 3.96MMbbls over the last week, compared to expectations of a 1.9MMbbls build, and also very different to the 2.81MMbbls build that the API reported the previous day. Crude oil imports fell by 721Mbbls/d to average 6.69MMbbls/d over the week. Imports from Saudi were a large contributor to this decline, with flows from the Kingdom falling by 203Mbbls/d to just 311Mbbls/d- the lowest weekly level going back as far as 2010.

However, refinery run rates in the US remain seasonally low, coming in at just 88.90% last week, and in fact saw a small decline week-on-week. A heavier maintenance season, along with a number of unplanned outages has hit refinery throughput, which has driven the declines that we have seen in refined products in recent months. Over the last week, gasoline and distillate fuel oil inventories fell by 596Mbbls and 159Mbbls, respectively.

Metals

Iron ore supply: The metals complex remains under pressure, and the next move is likely to be dictated by this week’s trade talks between China and the US. Failing to come to a deal, would see the US increase tariffs on Chinese goods at 12.01am on Friday. China has said that it would retaliate to any increase in tariffs.

However, iron ore continues to defy this broader macro pressure, with prices remaining well supported given the ongoing concerns over supply following the Vale dam disaster. Vale yesterday reported that its 1Q19 iron ore production came in at 72.9mt, down almost 28% quarter-on-quarter, and 11% lower year-on-year.

LME nickel spread: The LME nickel cash/3M spread has seen quite the move in recent days, moving from a contango of US$70/t at the start of the month to a three month high of US$40/t yesterday. The nickel market continues to tighten, with LME nickel inventories falling by 36kt (down 17% year-to-date) since the start of the year, leaving stocks at 171kt- the lowest level seen since early 2013. The INSG expects a supply/demand deficit of 84kt in 2019, somewhat smaller than the 146kt deficit seen last year.

Agriculture

Russia zero export tax extension: Russia’s Agricultural Ministry has proposed that the zero duty on wheat exports, which is set to expire on the 1 July, be extended for another year. This is no surprise. Russia is set to see a strong wheat harvest in the 2019/20 season, with the International Grains Council expecting the crop to reach almost 80mt. This would be an increase of around 8mt YoY and the second largest harvest on record.

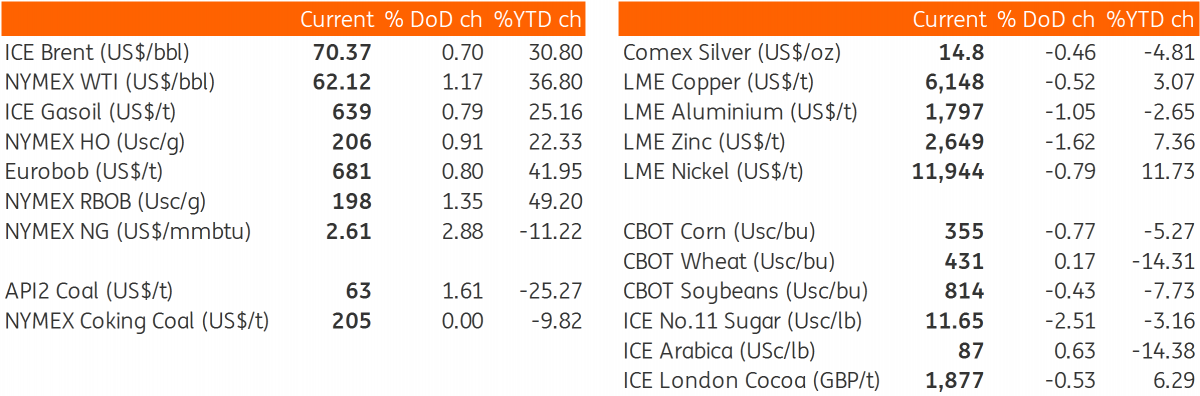

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap