The Commodities Feed: Saudi oilfield shutdown

Your daily roundup of commodity news and ING views

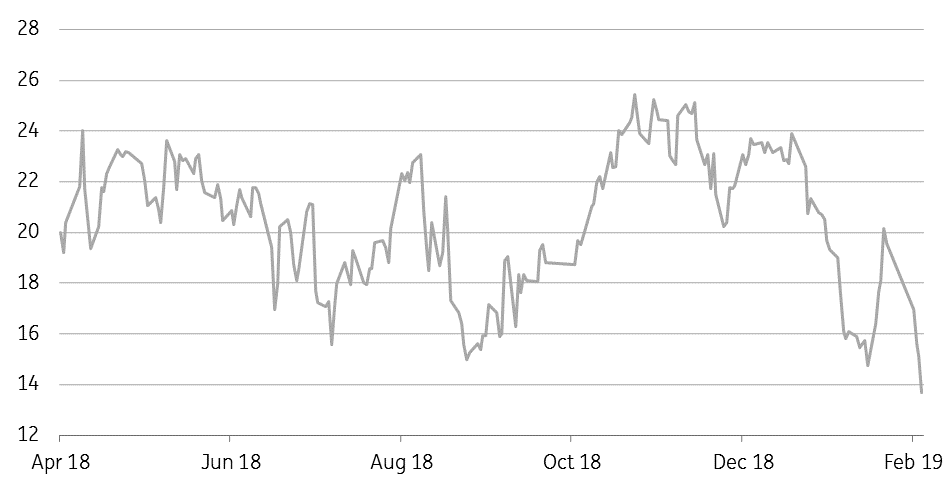

Iron ore 62% -58% premium narrows (US$/t)

Energy

Saudi oilfield shutdown: According to Energy Intelligence Group, Saudi Arabia has suspended production at its Safaniyah offshore field due to a damaged power cable. Safaniyah is the world’s largest offshore oilfield, with a capacity of as much as 1.5MMbbls/d, and operations could be halted until March. The impact on Saudi supply is not expected to be significant, with Saudi Aramco increasing output at other fields.

Refined product inventories: Latest data from PJK International shows that refined product inventories in the ARA region increased by 139kt over the last week to total 5.77mt. The increase was driven predominantly by gasoil and fuel oil, which saw increases of 139kt and 82kt, respectively. Meanwhile, gasoline and jet inventories declined over the week.

In Asia, refined product inventories in Singapore increased by 4.1MMbbls over the week to total 51.04MMbbls- the highest level of product stock since September 2017. The increase was driven by residual fuel oil, with inventories increasing by 3.94MMbbls over the week. Despite this big build, fuel oil cracks in Asia remain well supported.

Metals

Iron ore quality premium weakens: The premium of higher quality iron ore over lower quality iron ore continues to narrow. The 62%-58% ore premium has shrunk to $12.30/t, which is the smallest the premium has been in over a year. A key driver behind this move appears to reflect the fall in steel mill margins, and so input costs have become more important for mills. The general strength in the iron ore market, following the Vale accident is likely to continue supporting this trend.

Copper spread strength: The LME cash/3M spread has made quite a comeback so far in February, with the spread having strengthened from a $20/t contango at the start of the month, to a backwardation of $0.25/t currently. This is the strongest the spread has been since mid-December. We continue to hold a constructive view towards the copper market, driven by expectations of a refined copper deficit over the course of the year. However broader macro events, particularly trade negotiations are likely to dictate price action in the short term.

Agriculture

White sugar expiry: The Mar-19 white sugar contract, which expired on Wednesday at a $12.30/t discount to the May-19 contract, saw a fairly small delivery of 78,300 tonnes, according to exchange data. The bulk of the delivery came from India, although this sugar would have come from the coastal refiners who carry out tolling operations (with the raw sugar generally from Brazil), rather than coming from domestic production. Wilmar, which is usually a strong receiver of raws, reportedly took delivery of all sugar tendered.

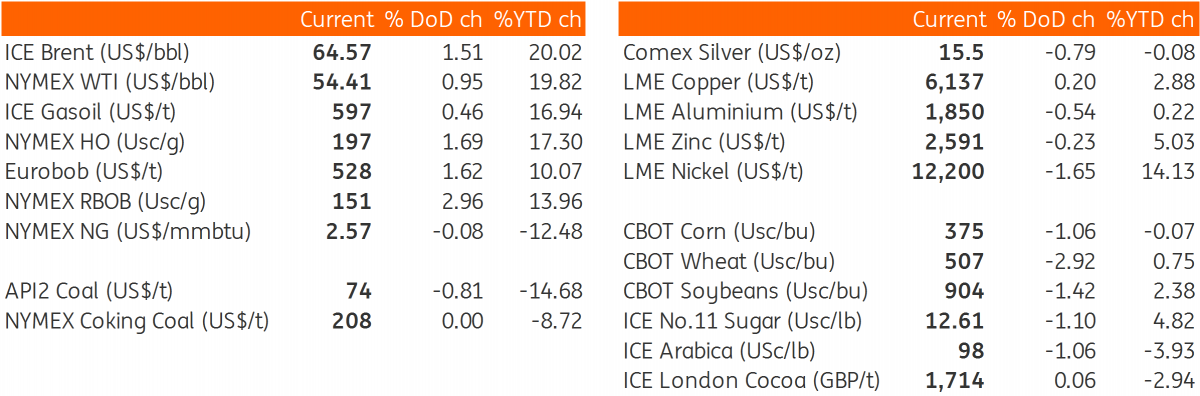

Daily price update

Download

Download snap