The Commodities Feed: Saudi Arabia OSP decreases

Your daily roundup of commodity news and ING views

Energy

ICE Brent remains under pressure after Saudi Arabia announced it would cut its official selling price (OSP) for most crude grades for October deliveries to help increase demand for its crude, this would be the second consecutive month it has cut prices. The OSP for Arab Light supplied to Asia was lowered by US$1.4/bbl to leave it at a discount of US$0.5/bbl to the benchmark. The OSP for Arab Light to Europe and the US was also lowered by US$0.2/bbl and US$0.6/bbl, respectively.

Data from China’s customs shows that crude oil imports into the country dropped 7.4% month-on-month to 47.5mt (11.2MMbbls/d) in August, as demand for inventories slowed due to capacity constraints and price recovery. Teapot refineries have also been reported to reduce operating rates as their import quotas for crude oil diminished, which further weighed on oil demand in the country. China’s demand slowdown comes at a time when the OPEC+ group has been easing production cuts and increasing supplies.

Metals

Most base metals were volatile last week with macro events largely dictating the market. The dollar index remains key to the overall markets. In the meantime, investors will be searching for evidence of demand. Investor profit taking saw nickel and zinc lose some lustre and correct lower towards the end of last week. Chile and Peru last week reported their latest copper production numbers for July, which showed that copper supply is mostly back on track. However, spot treatment charges for Chinese import concentrate are still anchored at multi-year lows, just below US50/t, weighing on cathode production growth. In the scrap market, market participants are waiting for further clarification and guidance on new customs codes in clearing scraps into the onshore China market.

According to the latest trade data, China imports of unwrought copper and copper products totalled 668,486 tonnes in August, up by 65.5% MoM, but that is still 12.3% lower from July. Copper concentrate imports in August hit 1.59 mn tonnes, and total imports in the first eight months fell by 1.3% YoY. Turning to aluminium, unwrought aluminium and aluminium exports reached 395kt in August, with total exports falling by 20.3% YoY from Jan-Aug. The aluminium import figures have yet to be released, but will be closely watched as China has turned into a net importer in both primary aluminium and alloys this year, which is a rare phenomenon.

As for the latest CFTC data, it shows that speculators increased their net long position in COMEX copper by 6,783 lots over the last reporting week (as of the week before 1 September), leaving them with a net long of 69,536 lots. For precious metals, speculators increased their net long in COMEX gold by 12,681 lots, to leave them with a net long of 151,021 lots as of last Tuesday.

The China Association of Automobile Manufacturers (CAAM) predicted last week that full-year car sales could still fall around 10% YoY. They expect the market to grow only slightly in the next five years (i.e. car sales to reach 27.75 mn vehicles in 2025, up from 25.77 mn in 2019 ). Since China emerged from lockdown, the quick recovery in the nation’s car market has been a significant source of metals demand recovery.

Agriculture

The USDA will be releasing its monthly WASDE report later this week and expectations are that the estimates for corn and soybean production in the US could be revised down further due to hurricane activity and poor crop progress. A Bloomberg survey shows that the estimates for corn production in the US could be revised down from 15.3bn bushels to 14.9bn bushels while estimates for soybean production could be lowered from 4.4bn bushels to 4.3bn bushels. Lower supply from the US would also weigh on the estimates of ending stocks both in the US and globally.

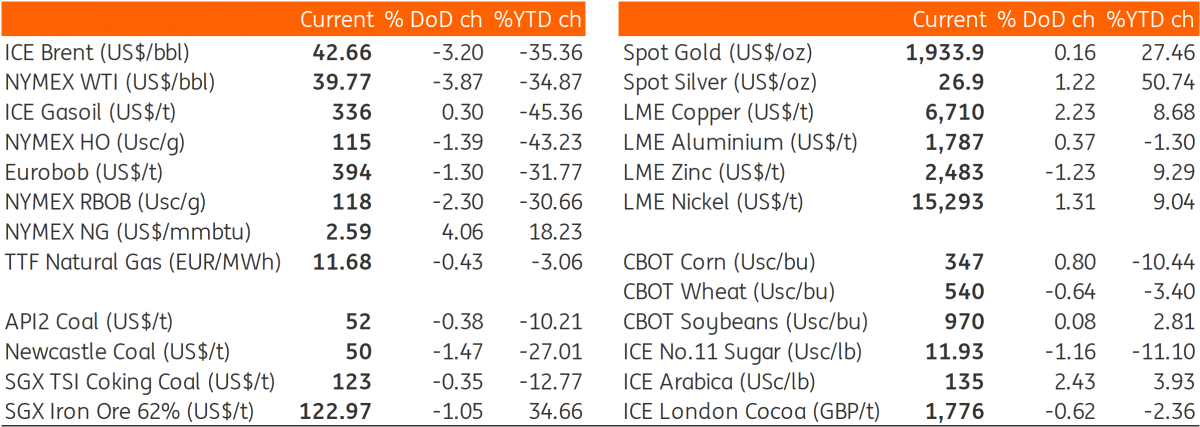

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap