The Commodities Feed: Russian oil contamination

Your daily roundup of commodity news and ING views

Energy

Russian oil issues: ICE Brent pushed above US$75/bbl yesterday, with news that a number of refineries in Poland, Germany and Slovakia suspended Russian oil imports via the Druzhba pipeline. High levels of organic chlorides are behind the suspension, which can lead to severe corrosion of refinery equipment. The Druzhba pipeline has a capacity of 1MMbbls/d, and reports suggest that the volume to Poland and Germany that was suspended was in the region of 700Mbbls/d. There have also been reports of contamination with crude loadings at the Baltic Sea terminal in Ust Luga. While more recently Ukraine has shut the Southern section of the Druzhba pipeline due to the same issue.

Russia has said that it plans to start pumping “clean and quality crude oil” through the pipeline as early as the 29 April. But some of the affected refineries expect the problem to continue for another week or two. In the meantime, refineries will have to turn to inventories and the seaborne market to ensure supply.

The disruption is clearly supportive for the spot market, which is reflected in the strength in the prompt Brent spread. But the bigger issue is that once again we are seeing disruptions to the heavier crude grades, a market which is already tight.

Metals

USD strength and base metals: The US dollar index continues to strengthen, reaching levels not seen since May 2017. This broader strength in the currency has weighed more recently on the base metals complex. US GDP numbers for 1Q are set to be released later today and it is looking increasingly likely that growth over the quarter could be somewhat stronger than many originally anticipated. If this turns out to be the case, we could see further USD strength, which could put some more downward pressure on the metals complex. Fundamentally though, we remain largely constructive towards the base metals complex in the medium- to long-term.

Lead smelter maintenance: A number of Chinese smelters will start maintenance next month, which is expected to impact almost 25,000 – 30,000 mt of primary lead production. Currently, operating rates in Henan, Hunan and Yunnan provinces averaged 59%. Lead prices have been under pressure for some time now, however smelter maintenance could offer some support to the market.

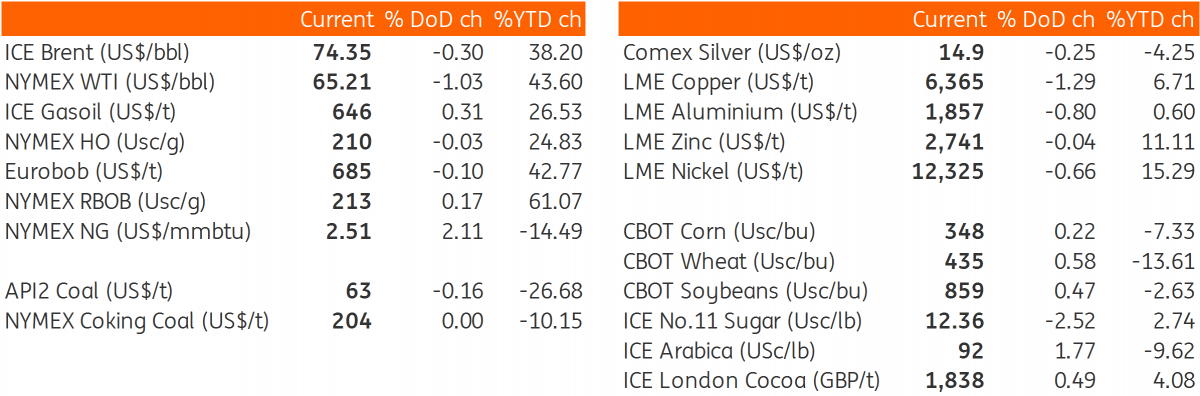

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap