The Commodities Feed: More cuts underway?

Your daily roundup of commodity news and ING views

Energy

NYMEX WTI has extended its gains and has been trading closer to US$20/bbl in the morning session. ICE Brent also strengthened, to US$27/bbl as producers announce deeper production cuts due to low prices. The sub-20 price environment for WTI has been making it extremely challenging for oil producers to continue pumping at an elevated pace. In the latest announcement, ConocoPhillips in the US has increased production cuts to 420Mbbls/d for June (nearly double the output cuts for the current month and one-third of its total capacity) and has halted all fracking activities for the rest of the year. US oil output has already dropped by c.900Mbbls/d since the end of March 2020 and likely to stay on a downward trajectory in the near future on increasing production cuts and falling rig counts. Meanwhile, in Europe Norway earlier announced an oil production cut of 250Mbbls/d for June and 134Mbbls/d for 2H20 in an effort to balance the market.

OPEC increased its oil production by around 1.6MMbbls/d in April 2020, according to a Reuters survey as countries opened the taps after a failed discussion on output cuts in March 2020. Saudi Arabia, UAE and Kuwait increased oil production during the month and pushed the oil market into bigger surplus before OPEC+ finally agreed on 9.7MMbbls/d of production cuts that start today. As discussed previously, the output cuts while significant may not be enough to fully offset demand destruction in the global market in the short term and the inventory build-up could continue for the rest of 2Q20, though at a slower pace.

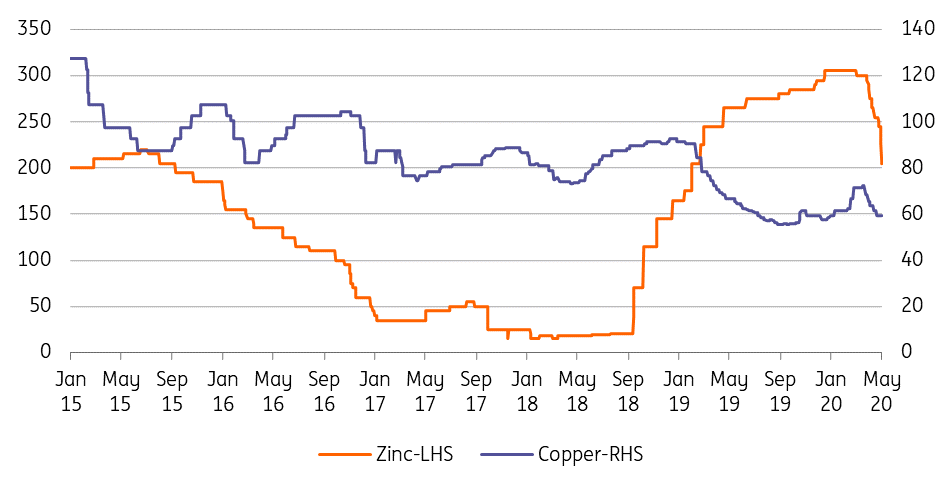

Copper and zinc spot treatment charges (US$/t)

Metals

The market ended April with a fall across all base metals yesterday. Just before China market headed into the Labour Day holidays (1 May-5 May), both official and CaixinPMI data was released. New export orders - a sub-index - read at only 33.5, a first indication of where the export market stands in April.

On the supply side, the major mining countries in Americas have just announced further extended lockdowns (mostly from 30 April), until 10 May (Bolivia, Argentina and Peru), and 30 May (Mexico). This will clearly increase the impact on base metal supply. In Bolivia, mining is even classified as non-essential. In late March, the San Cristóbal mine (Pb/Zn polymetallic) announced a suspension of mining activities on the site, and it doesn't appear it has resumed yet. During the latest round of company financial reporting for 1Q20, yesterday more companies trimmed base metals output guidance - including Glencore, Norilsk Nickel and Lundin. In the spot concentrate market, treatment charges (TCs) have already started to price the risk of concentrate supply growth . Both copper and zinc TCs offered in the China spot market have decreased, and are likely to be under further pressure in the next month. We expect smelters could be under pressures to run at lower capacities, potentially through frontloading maintenance works.

After falling dramatically, the recovery in metals demand has been continuing in China, as several micro indicators have suggested. Along with an increasing premium in the mainland physical market, the Yangshan copper premium has increased to US$90/t (the highest since November 2018), compared to US$57/t at the start of the year, and suggesting increased import appetite for copper. Entering May, metals demand from China could be faced with a reality check as to whether inventory drawdown is sustainable. We will be interested to see whether expectations are misplaced in terms of hopes for VAT cuts as well as for more concrete details on the fiscal stimulus, including infrastructure investment. The market could be volatile before clearer signals from the Chinese Parliamentary conference on 20 May. In the ex-China market, demand falls could bottom during May/June as some hard-hit countries have shown early signs of having peaked in Covid-19 cases.

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap