The Commodities Feed: Positive Chinese data

Your daily roundup of commodity news and ING views

China's economy showing some signs of improvement

Energy

US crude oil inventories: The API reported yesterday that US crude oil inventories declined by 3.1MMbbls, which went against market expectations for a crude oil build of around 2.3MMbbls. It also reported a larger-than-expected draw in gasoline stocks of 3.56MMbbls, whilst distillate fuel oil stocks saw a surprise build of 2.33MMbbls. Persistent draws in recent weeks have been bullish for gasoline cracks, with the May RBOB crack rally well above US$20/bbl, from below US$13/bbl at the end of January. However, refinery utilisation rates should pick up moving forward, which should see a reversal in the large draws that we have seen on the product side recently.

Pernis refinery strike: Strike action at the Pernis oil refinery in the Netherlands continues, and union leaders say that operating rates at the refinery will be kept at 65%. There is no suggestion when the refinery will return to full operation, but workers at the 400Mbbls/d refinery have been on strike since last Monday. As of yet, the disruption has not provided too much support to the gasoil crack and it remains below US$14/bbl.

Metals

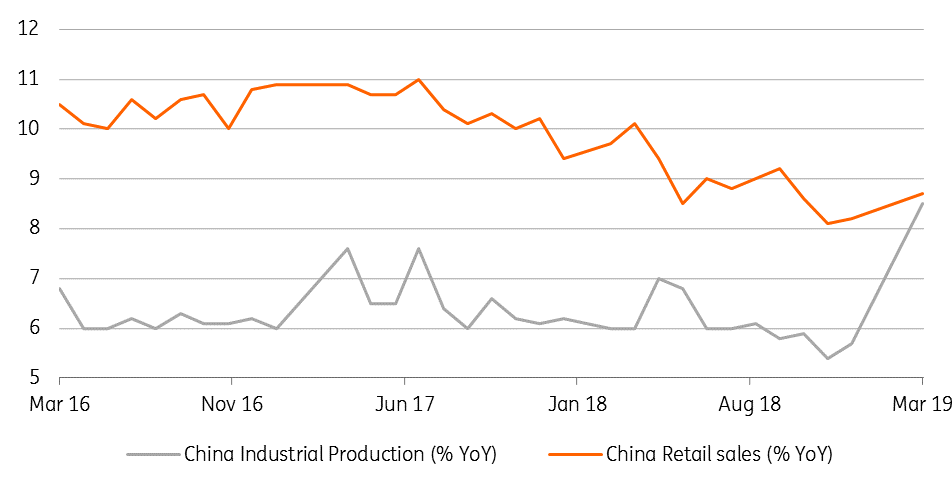

China data: Latest economic data out of China has been strong, with GDP recording steady growth of 6.4% in 1Q19 compared to expectations of around 6.3%, while industrial output was up 8.5% year-on-year in March compared to expectations of 5.6%. Retail sales also expanded by 8.7% in March, indicating improving consumer confidence. The better-than-expected economic data helps demand prospects; however some worries linger as to how Beijing will respond in terms of stimulus now that the economy is showing signs of improvement.

Metals production continues to increase at a healthy pace, with crude steel output up 10% YoY to total 80.3mt in March (cumulative output up 9.9% YoY to 231.1mt over the 1Q19) and primary aluminium output rising 3.4% YoY to 2.88mt (+3.9% YoY to 8.6mt over the first three months of the year).

Agriculture

Sugar refining cuts: Bloomberg reports that the Al Khaleej sugar refinery in Dubai has suspended operations once again, and this follows the 2.1mtpa refinery halting production from mid-December through to early February. Standalone refineries have been battling with a low whites premium- the Aug/Jul whites premium has traded to as low as US$51/t in April. The pressure is coming from a large exportable surplus of low quality white sugar from India, which is threatening to make its way onto the world market, along with Thai refined sugar.

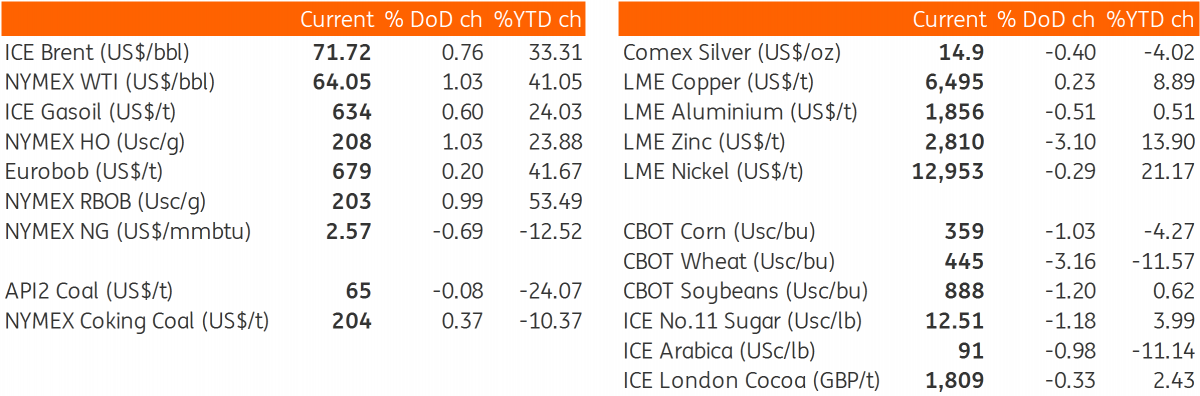

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap