The Commodities Feed: Pipeline disruptions

Your daily roundup of commodity news and ING views

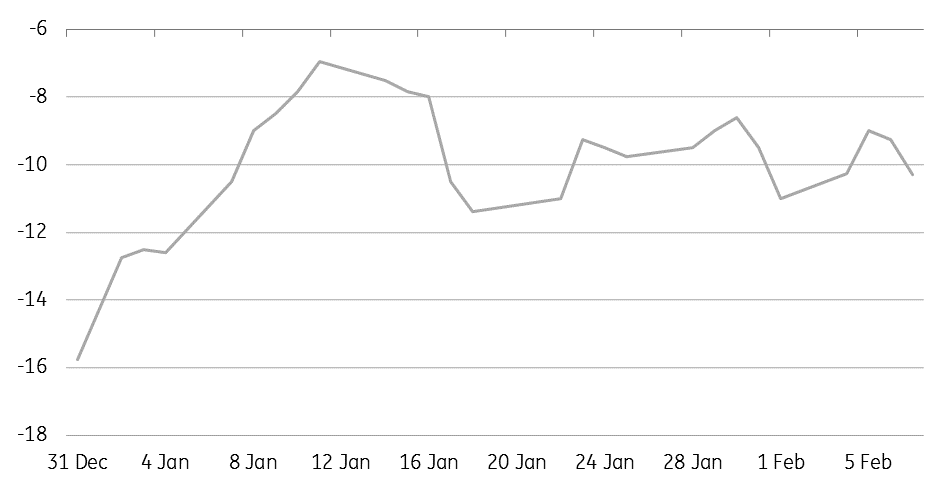

WCS/WTI differential (US$/bbl)

Energy

ARA product inventories: Latest data from PJK shows that gasoil inventories in the ARA region increased by 27kt over the week to total 2.4mt, the increase was driven by stronger imports. Still, gasoil inventories in the ARA region remain quite some distance away from the five-year average of close to 3mt for this stage of the year. Fuel oil inventories in the region increased by 59kt over the week to total 1mt. This is the first increase in fuel oil inventories since early January, with previous drawdowns driven by stronger flows to Asia. The 3.5% Rotterdam fuel oil crack has strengthened significantly on the back of this stronger demand for European product, with the crack rallying from more than a US$8.bbl discount in mid-December to almost a US$3/bbl discount currently.

Fuel oil inventories in Singapore have broadly trended higher from the levels seen in November, however inventories still remain towards the-5 year low at 19.3MMbbls.

Canadian pipeline shutdowns: Two pipelines in Canada remain partially shut, with concerns over a possible leak. TransCanada has in fact declared force majeure on Keystone oil flows. The disruption has seen the WCS-WTI differential weaken slightly, with the spread widening from a discount of US$9/bbl to a US$10.30/bbl discount.

Metals

US copper premium: According to a Bloomberg survey, the premium for physical copper in the US Midwest has increased to US¢8.125/lb, up from US¢7.5/lb in January, and is in fact the highest level seen in four years. COMEX copper inventories have continued to trend lower, falling around 28% so far this year, and hitting a two-year low of 79kt.

Agriculture

WASDE report: The grain markets are set to get a number of data releases today, following the US government shutdown. The USDA will be releasing both its latest WASDE report, along with its delayed quarterly stocks report. For the WASDE, the USDA will be reporting both January and February estimates. In terms of global ending stocks, the market is not expecting significant changes from the December report. The biggest change is the lowering of global soybean ending stocks for the current season from 115.3mt to 113mt.

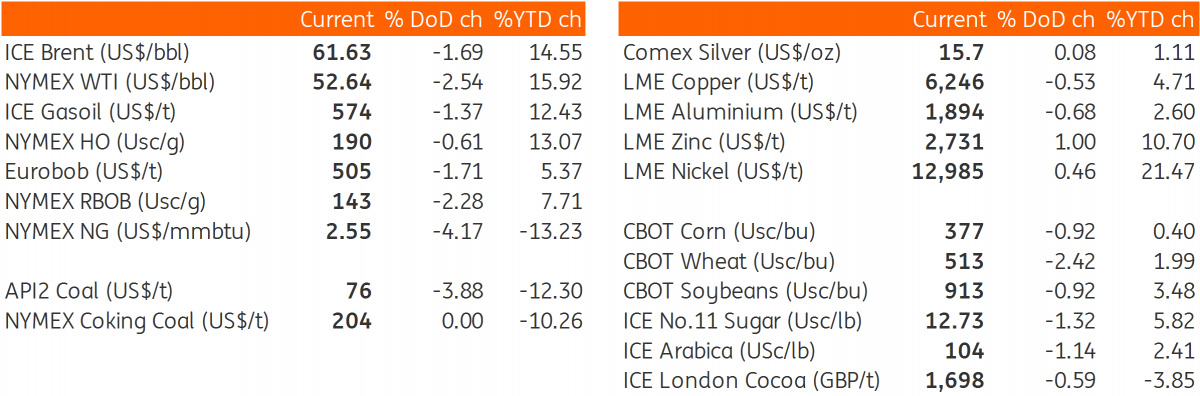

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap