The Commodities Feed: OPEC+ plans earlier meeting

Your daily roundup of commodity news and ING views

Energy

The oil market has largely ignored growing tensions between the US and China, with oil prices on Friday ending on a positive note, with WTI rallying by more than 5%, and managing to settle above US$35/bbl for the first time since early March. There is plenty of speculative money in WTI, with the managed money net-long position increasing by 14,266 lots over the last reporting week, to leave them with a net-long of 362,724 lots as of last Tuesday. This is the largest net-long speculators have held in WTI since September 2018, showing that speculators have taken advantage of lower prices for an attractive entry point. The fact that we have seen a significant slowdown in US drilling, and production shut-ins, will give these speculative longs some confidence, or at least comfort. Interestingly, ICE Brent has not seen the same degree of buying interest from speculators in recent weeks. While the managed money net-long in ICE Brent increased by 14,757 lots over the last reporting week, the overall position is still rather small, with the net-long standing at 173,196 lots, well below the almost 430k net-long position seen at the beginning of the year.

The divergence between WTI and Brent is well reflected in the spread, with WTI’s discount to Brent narrowing significantly in recent weeks, and currently at around US$2/bbl, compared to more than US$7/bbl at the end of April. The fact that we have now seen three consecutive weeks of stock draws at Cushing, has eased fears of reaching tank tops at the WTI delivery hub, and as a result, has offered relatively more upside to WTI prices.

Finally, there is a proposal to bring forward the OPEC+ meeting to the 4 June, which is currently scheduled for 9-10 June, as this would allow any changes to production cuts to be factored into July nominations. In addition, there are media reports that the alliance are looking at extending current cuts of 9.7MMbbls/d anywhere between 1-3 months. Under the current deal, the group are set to reduce the scale of cuts to 7.7MMbbls/d from July. A shorter period may make an extension more palatable to the Russians, who were not keen to extend current cuts through until the end of this year, which was reportedly suggested by other members of the deal.

Metals

May was a fairly positive month for base metals, and they mostly finished higher over the month, with signs of economies reopening. However, towards the end of the month, the macro backdrop has darkened amid a flaring-up in tensions between the US and China. The latest official PMI reading from China also pointed towards weaker manufacturing activity over May; However, the construction PMI, a sub-index, surged to 60.8 in May versus 59.7 in April. New export orders continue to struggle though, with a reading of 35.3, and firmly in the contraction zone.

Inventories mostly continued their downward trend last week on ShFE. Copper inventories at exchange warehouses fell by 31kt over the week to total 145kt as of 29th May. YTD net inflows now stand at 21kt, compared to net outflows of 86kt during the same time last year. Among other metals, aluminium weekly stocks reported outflows of 26kt (for a tenth straight week) to total 297kt as of Friday. Net outflows in May almost doubled to 114kt, compared to net outflows of 63kt a month earlier. Zinc inventories also eased 3.5% over the week, to reach a four-month low of 107kt.

Meanwhile, in metals supply, Boliden has halted copper and nickel processing operations at its Kevitsa mine in Finland after a fire broke out at the plant, causing severe damage. Production at the concentrate plant has been halted, while mining operations remain unaffected. The mine produced 27.5kt of copper concentrate and 14kt of nickel concentrate in 2018

As for iron ore, the market remains well supported, with prices flirting with the US$100/t mark. Steel margins in China continue to trend higher, whilst there are concerns over Brazilian supply, amid the Covid-19 outbreak. Meanwhile, the latest Steelhome data show that Chinese iron ore port inventories reported their seventh straight weekly decline, with total stocks declining by 0.5mt over the week to total 109.5mt (lowest since November 2016) as of 29th May. YTD net outflows now stand 21mt, compared to net outflows of 14mt during the same period last year.

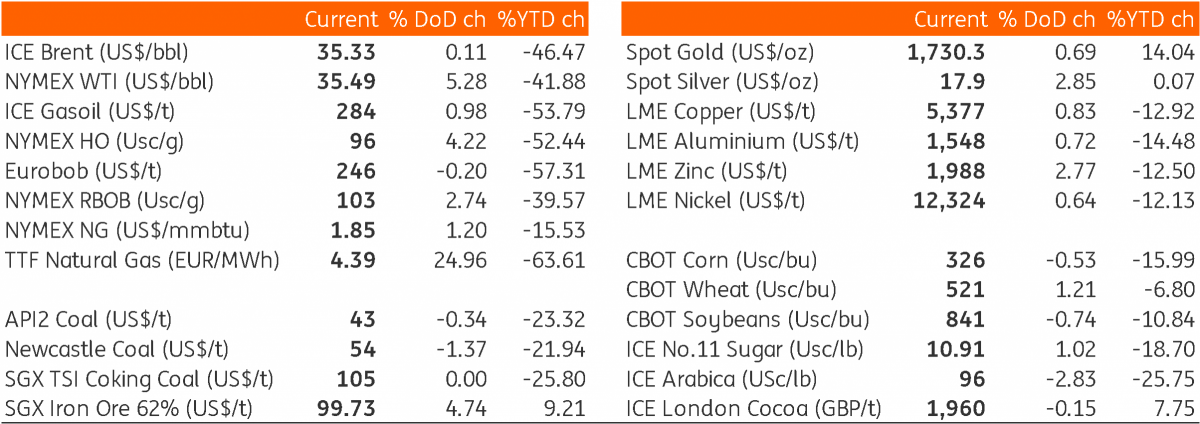

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap