The Commodities Feed: OPEC output falls

Your daily roundup of commodity news and ING views

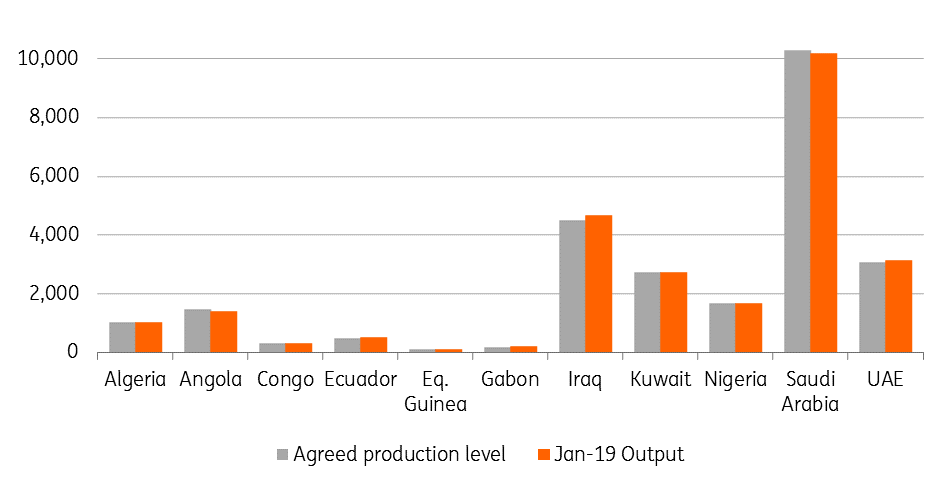

OPEC agreed production level vs. January 2019 production estimate (Mbbls/d)

Energy

OPEC+ oil output: According to Bloomberg estimates, OPEC production fell by 1.53MMbbls/

Further

Metals

Iron ore strength: Following the fatal dam failure in Brazil, iron ore prices have rallied well above US$85/

Agriculture

China buys further US soybeans: Following trade talks in the US last week, China has bought further US soybeans, with both

Indian sugar production: Latest data from the Indian Sugar Mills Association (ISMA) shows that cumulative sugar production through to the end of January stands at 18.5mt, compared to 17.1mt at the same stage in the 2017/18 season. The stronger output so far this season is

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap