The Commodities Feed: Oil strength continues

Your daily roundup of commodity news and ING views

Energy

The positive sentiment in the market has continued this week following the IEA’s release last Thursday. WTI is now trading back above US$30/bbl, while the WTI Jun/Jul spread traded briefly in backwardation on Friday, ahead of this week’s contract expiry. This is a big shift from last month, where we saw the May/Jun spread trade to a contango as deep as US$60/bbl at one stage. Clearly the fundamentals in the market are improving, but we continue to believe that the market is rallying too much too soon, with the risk that further strength will only prolong the supply and demand imbalance.

Meanwhile Baker Hughes data on Friday continued to show a collapse in US drilling activity, with the number of active oil rigs in the US falling by 34 over the week, to total 258. Total oil rigs are now down more than 62% since mid-March, and at levels last seen in 2009. Sticking with the US, and while it is fairly quiet week when it comes to data releases, regulators in North Dakota will discuss the potential for production quotas on Wednesday. North Dakota is a fairly small producer, pumping only around 1.4MMbbls/d, compare to more than 5MMbbls/d from Texas.

Finally, Saudi Arabia and Kuwait have decided to suspend output at the Khafji field in the neutral zone in June, according to media reports. This follows both countries last week announcing deeper output cuts for June, in an effort to speed up the rebalancing of the market. It is estimated that the cut from the field will total 80Mbbls/d.

LME zinc cash/3M spread (US$/t)

Metals

The weaker macro-environment, concerns over a second wave of Covid-19, and escalation of trade tensions between the US and China have further weighed on market sentiment, which saw base metals trade lower last week. In the latest CFTC data, non-commercials still remained net short Comex copper, as of last Tuesday.

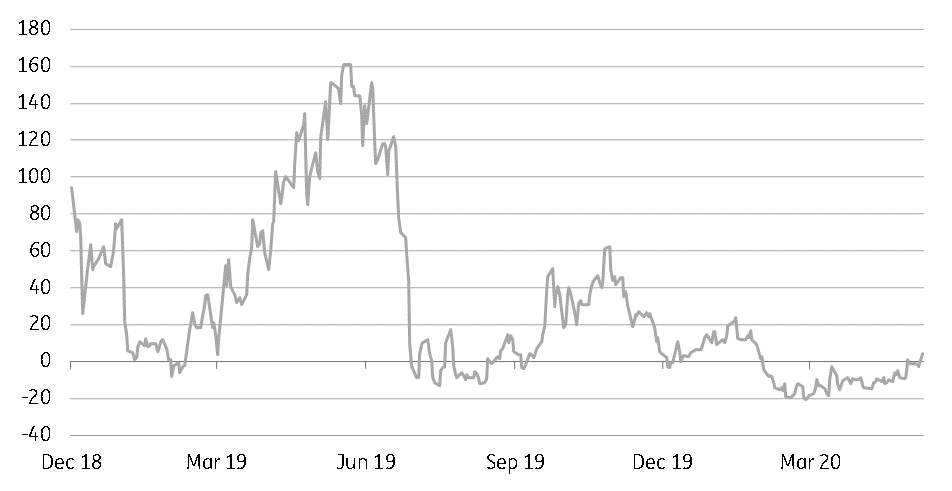

Turning to the LME, base metals remained in contango, with the exception of zinc, where the front end flipped into a small backwardation. However, the inventory move has been moderate since April, and last week there were only 1,200 tonnes of stock outflows.

The tightening at the front end of the curve has two fundamental factors underpinning it. Firstly, as we discussed here, pressure from falling treatment charges (TCs) on smelters, has started to weigh on refined production growth. We expect growth over April and May will be muted. Over the last week, spot TCs have fallen by a further US$10/tonne to US$165/tonne. Secondly, expectations are growing for a marginal improvement in demand from Europe, following the recent easing in some country lockdowns.

As for the latest data releases, the China National Bureau of Statistics (NBS) released aggregated April output of non-ferrous metals (including copper, aluminium and others), which pointed to a growth of 2.1%MoM (+3.8% YoY) to total 4.93mt in April 2020. Aluminium output in the country recovered from 95.8kt/day in March to 99kt/day in April, the highest daily output since June 2019. Meanwhile steel production also recovered from 2.55mt/day in March to 2.83mt/day in April.

Finally, data from SHFE continues to show inventory withdrawals for aluminium (-36.6kt) and zinc (6kt), while copper inventories increased by a marginal 4.7kt last week. In aluminium, an increased proportion of molten aluminium relative to ingots from smelters, means limited inflows to reportable inventories.

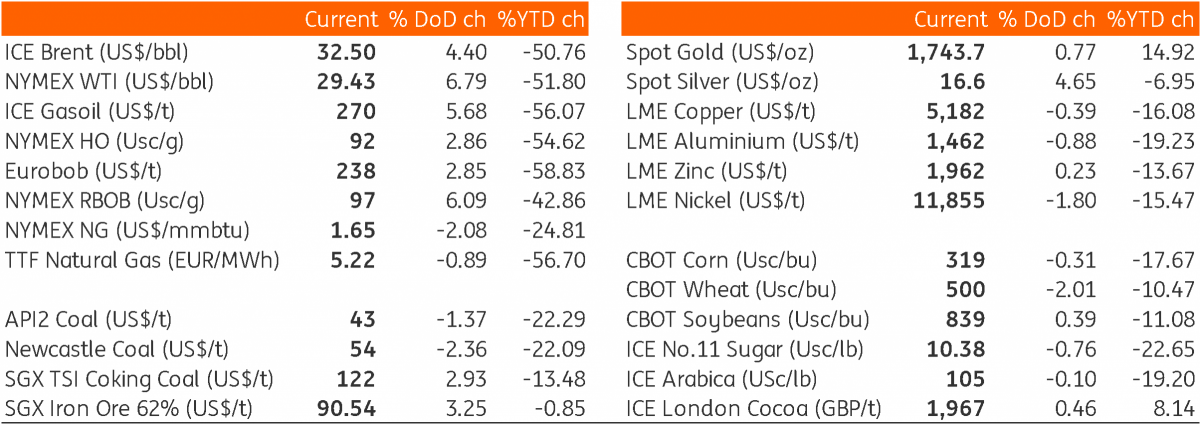

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap