The Commodities Feed: Oil still under pressure

Your daily roundup of commodity news and ING views

Energy

Crude oil continued to trade soft this week on improving supplies in the immediate term while demand uncertainty continues.

Both the ICE-Brent and NYMEX-WTI forward curve widened over the week with prompt month trading at a deeper discount to the December contract reflecting the higher supplies in the spot market. On refined products, data from Insight Global shows that the gasoil inventory in the ARA region dropped by 152kt last week on lack of cargo arrivals at the ports.

The hurricane activity in the US over the past few weeks has reduced diesel shipments in the short term and created some supply tightness. However, the inventory withdrawal wasn’t much of a support to the gasoil cracks in Europe which dropped to a fresh ten-year low of below US$3/bbl due to subdued demand and a large stockpile in the US and Asia. Meanwhile, International Enterprise reported that Singapore middle distillate inventory increased by a huge 1.7MMbbls last week, pushing up the distillate inventory to a nine-year high of 16MMbbls and only marginally down from the record peak of 16.7MMbbls made in August 2010.

Next week, China will be releasing its monthly oil import numbers on Monday and will be watched closely to gauge the strength of oil demand in the country. Then we have EIA’s Short-Term Energy Outlook on Wednesday which will have its updated US oil production forecasts for this year and next. And there will be usual API and EIA weekly reports which will reflect the post-hurricane restarts activity.

Metals

Metals continued to be traded under pressure amid a strengthing dollar index.

Nickel’s bull run hit the brakes with the London three-month prices dropping by over 3% DoD yesterday. The recent strong performance has made nickel the second-best performer in LME base metals complex on a year-to-date basis. According to SHMET, Chinese NPI (nickel pig iron) productions continued to fall in August (-9% MoM) as a result of cutbacks amid ore supply tightness. Tight ore supply has been one of the bull drivers behind the recent rally, and low inventory at Chinese ports may remain a case throughout the year.

Turning to copper, data release from South America suggested that Chilean copper productions have grown by 1.4% YoY to 3.25 mln tonnes during the first seven months despite Covid-19 threats. July productions saw a decline of 5% YoY due to disruptions at several operations.

According to SMM, Chinese bonded warehouses stocks have risen to 249.5kt at import arrivals, but they are getting slower to be cleared into the local market as demand hasn’t come out of a seasonal lull.

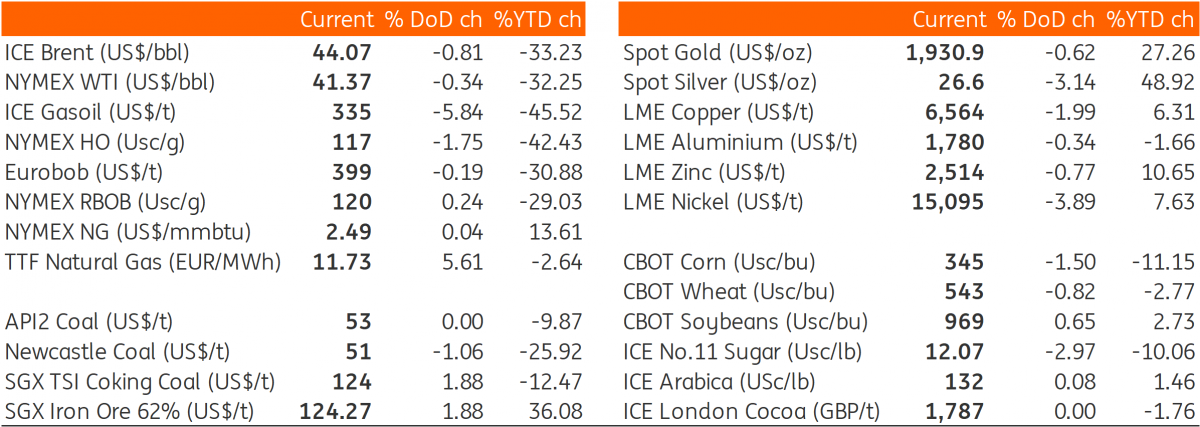

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Tags

Commodities FeedDownload

Download snap