The Commodities Feed: Oil spreads strengthen

Your daily roundup of commodity news and ING views

ICE Brent Mar/Apr spread rallies (US$/bbl)

Energy

US crude oil inventories: The EIA yesterday reported that US crude oil inventories declined by 2.68MMbbls over the last week, which was broadly in line with market expectations for a draw of around 2.5MMbbls, although larger than the 560Mbbls draw the API reported the previous day. Crude oil imports fell by 319Mbbls/d to 7.53MMbbls/d, and this move was largely due to Saudi flows falling by 323Mbbls/d over the week to 684Mbbls/d. However on the more bearish side, the EIA estimates that US crude oil production increased by 200Mbbls/d to a record 11.9MMbbls/d over the week. It also reported that gasoline inventories in the country increased by 7.5MMbbls, keeping stocks above the five-year high for this stage in the year, whilst distillate fuel oil inventories increased by 2.97MMbbls.

Brent spreads strengthen: The front-month ICE Brent spread has continued to strengthen, and in fact this morning has swung back into backwardation. As OPEC+ cuts start to be felt in the market we believe that this should continue to be supportive for the front end of the curve. Whilst a return to backwardation may also attract speculative longs back into the market, with the positive roll yield. Returning to the topic of OPEC+ cuts, the Russian deputy energy minister has said that Russia should meet its target with the current production cut deal by April.

Metals

Alunorte and Rusal: There have been plenty of developments in the aluminium market in recent days. The Alunorte alumina refinery in Brazil has moved one step closer to seeing operations returning to normal, following the local environmental agency, SEMAS, giving its approval for a restart. However, the refinery is still awaiting the federal court to lift its embargo on production. Moving to Rusal, and the US Senate has blocked a Democratic bid to keep Rusal sanctions in place. These developments are likely to keep the pressure on LME aluminium in the immediate term. However in the longer term, the fundamental outlook for aluminium remains constructive, with yet another sizeable ex-China deficit in 2019.

China stimulus and trade talks: The base metals complex has been fairly well supported in recent days with further stimulus coming through from the Chinese government. The PBOC on Wednesday injected a record US$83 billion into the financial system in order to improve liquidity. While on the trade side, it does appear we will see further progress in talks between China and the US, with the Chinese confirming this morning that the Vice Premier will be travelling to the US at the end of this month to attend trade talks.

Agriculture

European cocoa grinding: The European Cocoa Association reports that cocoa processing in Europe rose by 1.6% year-on-year to total 359,103 tonnes over 4Q18, which was slightly below market expectations of a 2% increase, according to a Bloomberg survey. This takes total grinding over 2018 to 1.44mt, up 4.2% YoY. Grinding figures for North America will be released later today.

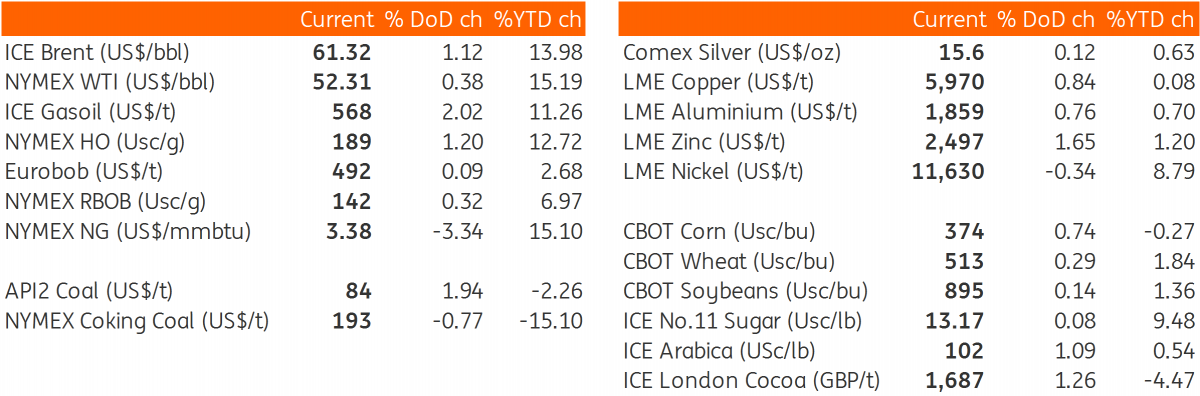

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap