The Commodities Feed: No US waivers for Iranian oil

Your daily roundup of commodity news and ING views

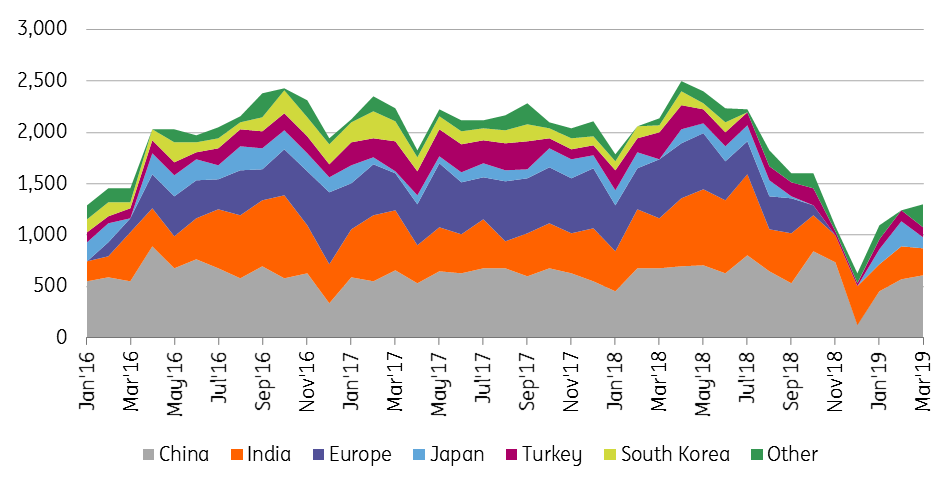

Iranian oil exports by destination (Mbbls/d)

Energy

No US waivers for Iranian oil: The US announced its intention yesterday not to extend waivers for buyers of Iranian crude oil, which are set to expire on 2 May. The announcement was fairly surprising and this was reflected in the rally in flat price. Iranian oil exports over March averaged 1.3MMbbls/d, according to Bloomberg ship tracking data, and so if the US is successful in reducing exports to zero, this would lead to significant tightness in the oil market. However, we do believe that cutting off exports completely is an unlikely scenario.

The Saudi energy minister has said that the Kingdom and other OPEC members will ensure that the market is well balanced moving forward following the US decision on waivers. Saudi Arabia has plenty of room to increase output and still comply with the production cut deal. Under the deal, the Kingdom should be producing around 10.3MMbbls/d, yet over the last couple of months the Saudis have been pumping around 9.8MMbbls/d. As we head into summer though, it's expected that domestic output will increase.

Given that the US will not extend waivers, it will likely be increasingly difficult for OPEC+ to justify extending its current production cut deal into the second half of this year.

US crude oil inventories: The API is scheduled to release its weekly inventory numbers for the US today and market expectations are that crude oil inventories increased by around 500Mbbls over the last week. Draws are expected for both gasoline and distillate fuel oil. Additional drawdowns in gasoline inventories will only push stock levels further below the five-year average, which would be supportive for the gasoline crack.

Metals

China copper: Treatment charges in China for copper smelters have fallen to a more than five-year low of US$66.5/t as new capacity comes online. Treatment charges are down nearly 20% since the start of the year- as a result hitting the profitability of smelters. Meanwhile, the spot premium for copper has weakened by 6.5% in April so far, and 25% since the start of the year to US$50.5/t. Large inflows of copper into SHFE warehouses and uncertainty over demand has weighed on physical premiums. However positive economic data more recently, along with prospects of a US/China trade deal should offer some support to the demand picture.

Steel cuts: The majority of steel mills in Tangshan in Hebei province in China have been asked to cut 40% of their sintering capacity this week as pollution levels are expected to increase. While those mills with higher emission levels could be ordered to shut operations over the period.

Agriculture

USDA export inspections: Latest data from the USDA shows that US corn inspections for export over the last week totalled 1.35mt, up from 1.18mt last week. Cumulative inspections so far this season total 33.28mt, up from 29.82mt. Soybean export inspections over the week totalled 382kt, down from 476kt the week before. Total soybean inspections so far this season total 31.05mt, down from 42.82mt at the same stage last season. Over the last week, 67kt of soybeans inspected for export were destined for China.

Download

Download snap