The Commodities Feed: Nickel extends losses

Your daily roundup of commodity news and ING views

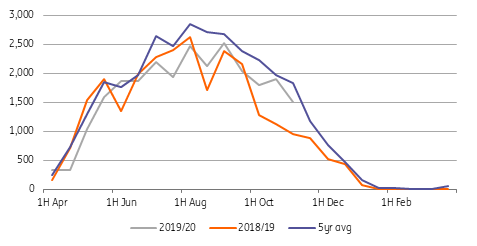

Center-south Brazil sugar production

Energy

Canada oil: The discount for West Canada Select (WCS) crude over the WTI narrowed from US$22.85/bbl on Friday to US$21/bbl on Monday after the 590Mbbls/d Keystone pipeline was reported to resume service after repair work was completed. The pipeline was offline since late last month due to a leak which created a supply glut locally. Meanwhile, Canada has been easing restrictions on crude oil production to support the economy, which could weigh on the price differential in the longer term. Over the past two weeks, the country has allowed oil companies to exceed oil output limits if excess oil is transported by rail, and new conventional oil wells are exempted from the production restrictions.

US LNG: The US continues to increase its LNG shipments supported by strong natural gas production in the country. Combined with an abundance of stock in Europe and Asia, this is likely to weigh on gas prices in the European and Asian market this winter. Bloomberg data shows that gas deliveries to US LNG terminals have increased to a record average of 7.3Bcf/d in November so far compared to an average of 6.6Bcf/d in October 2019 and an average of 4.3Bcf/d a year ago. On the other hand, Chinese LNG demand has been slow in October due to an economic slowdown, relatively relaxed policies on coal and a shutdown at one of the LNG receiving terminals in the country.

Metals

Base metals: Nickel saw another selloff on Monday with LME 3-month prices falling further below $16,000/tonne. Indonesia has revoked ore exports from nine firms after a recent suspension for investigations of suspected policy violations. Ore shipments from the country are said to have restarted but still face uncertainty in December while the ban from 2020 remains in place so far. Meanwhile, developments in the Chinese market remain volatile. Nickel is facing headwinds from the local stainless steel market, which has seen a major selloff.

The aluminium spread in LME eased on Monday, with the Dec19-Dec20 spread coming off from backwardation of $17.5 to $16. We still think that this is likely to be due to some forward hedging activities along the curve. Meanwhile, the near term ShFE market still looks vulnerable to a bearish squeeze. With stock continuing to decline in China, the relative market strength looks stronger compared to LME. That said, divergence between the two markets may return.

Turning to lead, Nyrstar is said to restart its Australia-based lead plant Port Pirie soon, according to a Bloomberg report. The first feed of raw material will commence on 14 November. This is adding to the recent sluggish sentiment from China as a result of the major stock increase. LME lead is facing pressure but the market focus may turn to the reality that inventory has been in a continuous decline. The disparity between the 'expectation and reality' for zinc looks heightened by today's headline data. On the one hand, October refined production from China has grown by over 15% year-on-year to a record high, according to SMM. On the other hand, LME inventories have fallen for the past 31 days to the lowest since 1990. We want to reiterate that low inventory from the LME should continue to support prices for both lead and zinc in the short term although the outlook is fundamentally bearish and will eventually take a bite out of prices.

Agriculture

Brazil sugar: Sugar production in the Center-South region of Brazil dropped to 1.5mt over the second half of October 2019 compared to 1.9mt over the first half of the month as cane crushing dropped further to 32.6mt whilst millers continue to allocate more cane towards ethanol production. 32.1% of cane was allocated for sugar production over 2H-Oct compared to 34.65% in 1H-Oct. Year-to-date sugar production is up 3.3% YoY to 25.2mt due to low production in 2018/19 when it fell 27% YoY. Lower sugar production from Brazil, India (adverse weather) and the US (due to freezing weather in sugar beet producing regions) could continue to support sugar prices though inventory overhang remains a concern.

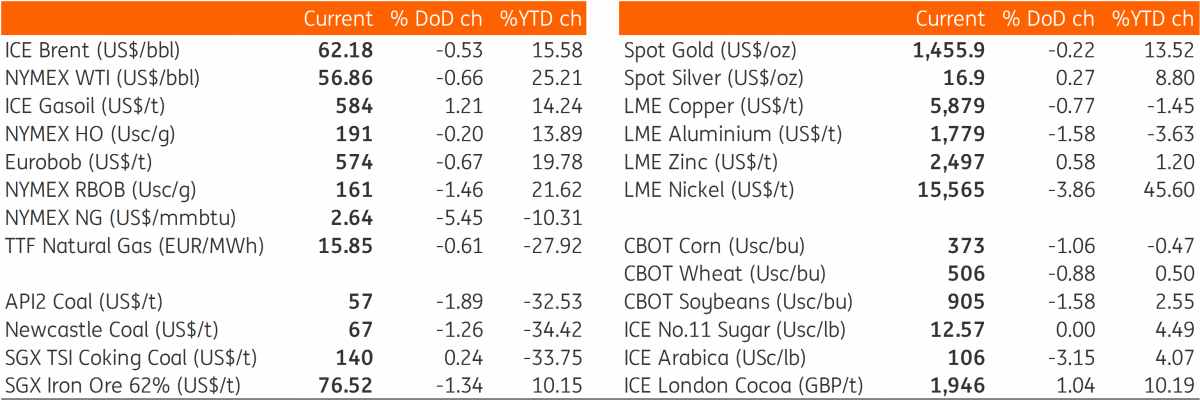

Daily price update

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Download

Download snap